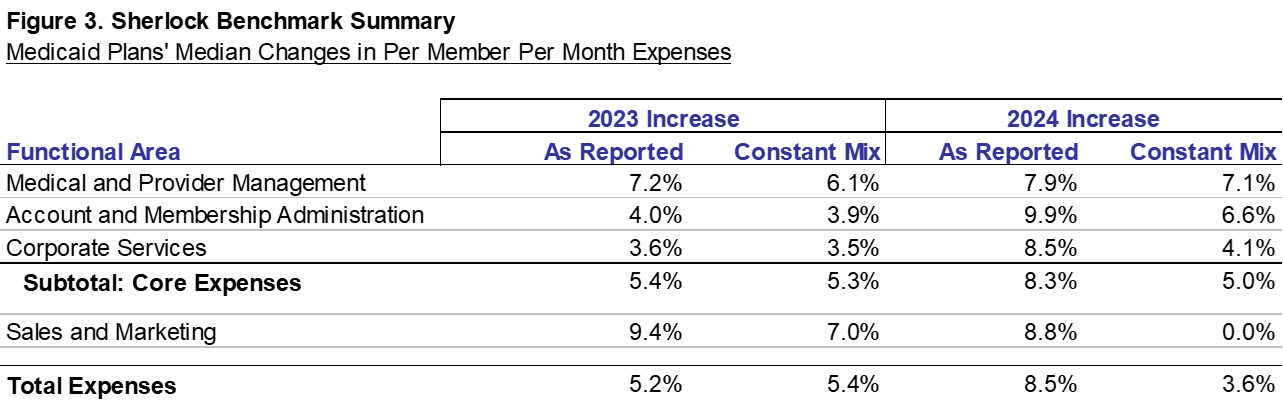

The Analysis

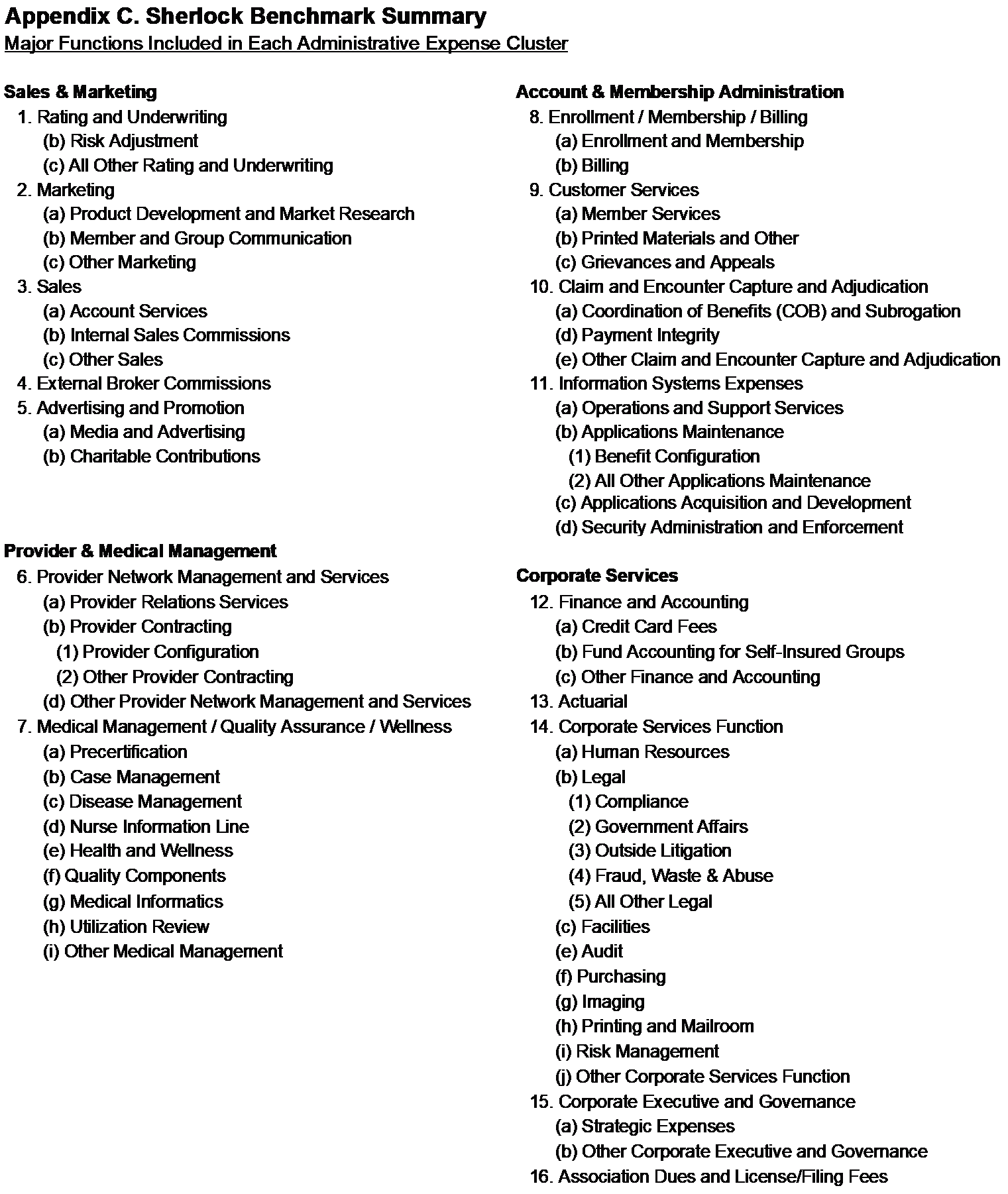

"Core" per member administrative expenses (excluding any Sales and Marketing costs) in Medicaid-focused plans grew by 5.0% in 2024, slower than the 5.3% growth in 2023. However, the growth to Account and Membership cluster accelerated to 6.6% in 2024, compared to the 3.9% in the prior year. Administrative cost trends for Medicaid is of particular interest to health plan managers because of declines in health plan membership, discussed later.

Figure 1 displays both Core and Account and Membership Administration expense trends since 2012. The rates of change reflected here hold constant both surveyed plans and their product mix in each year-over-year comparison. Cost trends in 2024 for both Core and Account and Membership Administration cluster of expenses were above the average since 2012. (The 13-year average for Core and Account and Administration expenses was 3.6% and 4.1%, respectively.) Account and Membership Administration was the highest since 2019 and Total administrative costs were the third highest since 2019.

This Plan Management Navigator summarizes the results of 14 health plans serving 13.8 million members that participated in the Sherlock Benchmarks for Medicaid plans. Of those members, 9.7 million were Medicaid or CHIP. Figures that refer to PMPM costs are based on the results of the continuing plans plus new participants. The cost trends for 2024 are based on the results of eleven continuous plans serving 7.4 million members in comprehensive products, of which 4.2 million were Medicaid or CHIP.

The term "Core" expenses excludes the Sales and Marketing cluster. State laws governing Sales and Marketing for Medicaid vary so we separate such activities from Medical and Provider Management, Account and Membership Administration and Corporate Services to preserve comparability between plans operating in different states. The Sales and Marketing cluster is composed of Rating and Underwriting, Marketing, Sales, Advertising and Promotion and Broker Commissions.

Background on Medicaid

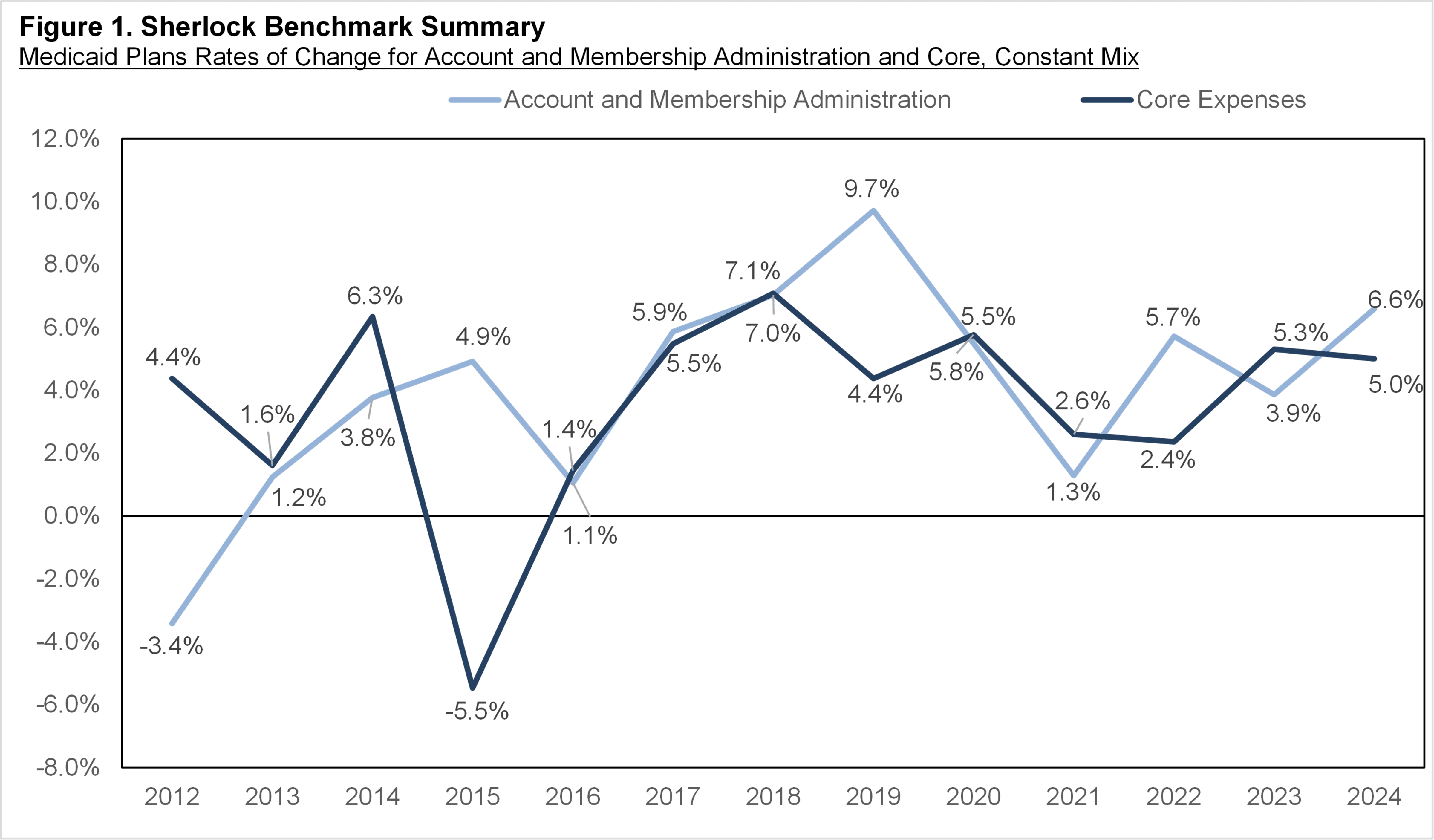

One of the central purposes of the Affordable Care Act was to reduce the proportion of Americans without health insurance. As shown in Figure 2, based on US Census Bureau population surveys and analyses, Health Insurance Coverage in the United States: 2024 (published annually, most recently in September 2025), the proportion of Americans uninsured dropped from 13% in 2014 to 8% in 2023, approximately a 5-percentage point decline. The proportion of people without health insurance has been 8% or 9% from 2015 through 2024.

Medicaid has historically been integral to this improvement. In 2014, the first year of the Affordable Care Act, Medicaid surged by 12% or by 6.7 million people, increasing from 18% to 19% of the US population. The percent of people who were uninsured fell from 13% to 10%. Peak Medicaid enrollment was 62.4 million in 2015. Enrollment declined or was flat in 2016 through 2019. Due to Covid-19 adaptation compressing the economy and the temporary suspension of Medicaid eligibility redetermination from the Public Health Emergency (PHE) declaration, Medicaid participation increased in each year from 2020 to 2023. The recommencement of Medicaid redeterminations in 2024 led to declines in Medicaid members.

Subject to qualifications noted on the chart, of the 14.7 million net decline in uninsured since 2013, the 4.5 million additions to Medicaid beneficiaries explained 31% of the decline. Participation in Medicaid is likely sensitive to economic cycles, however they arise. While the unemployment rate spiked to 14.7% in 2020, it dropped to pre-pandemic levels in 2022 and has ranged from 3.7% to 4.3% in 2024.

Employer-based coverage increased by about 3.1 million people from 2023 to 2024 to 181.3 million. At the same time, Medicaid fell sharply by 3.3 million people to 59.4 million. Longer term, membership in employer-based coverage increased by 6.9 million people from 2013 to 2024, while Medicare increased by 15.3 million people.

Direct purchase of health coverage ("Coverage purchased directly from an insurance company, or through a federal or state Marketplace") increased by 2.2 million people from 2023 to 2024. From 2013 to 2024, the number of people obtaining health insurance through Direct Purchase increased by about 295,000.

Kaiser Family Foundation uses a different data set (analysis published September 30, 2025) and concludes that in June 2025, Medicaid had an "18% decline from total Medicaid/CHIP enrollment in March 2023." Since some administrative expenses are sticky in the short term, declines in membership may lead to increases in administrative costs.

Trends Overall and in Expense Clusters

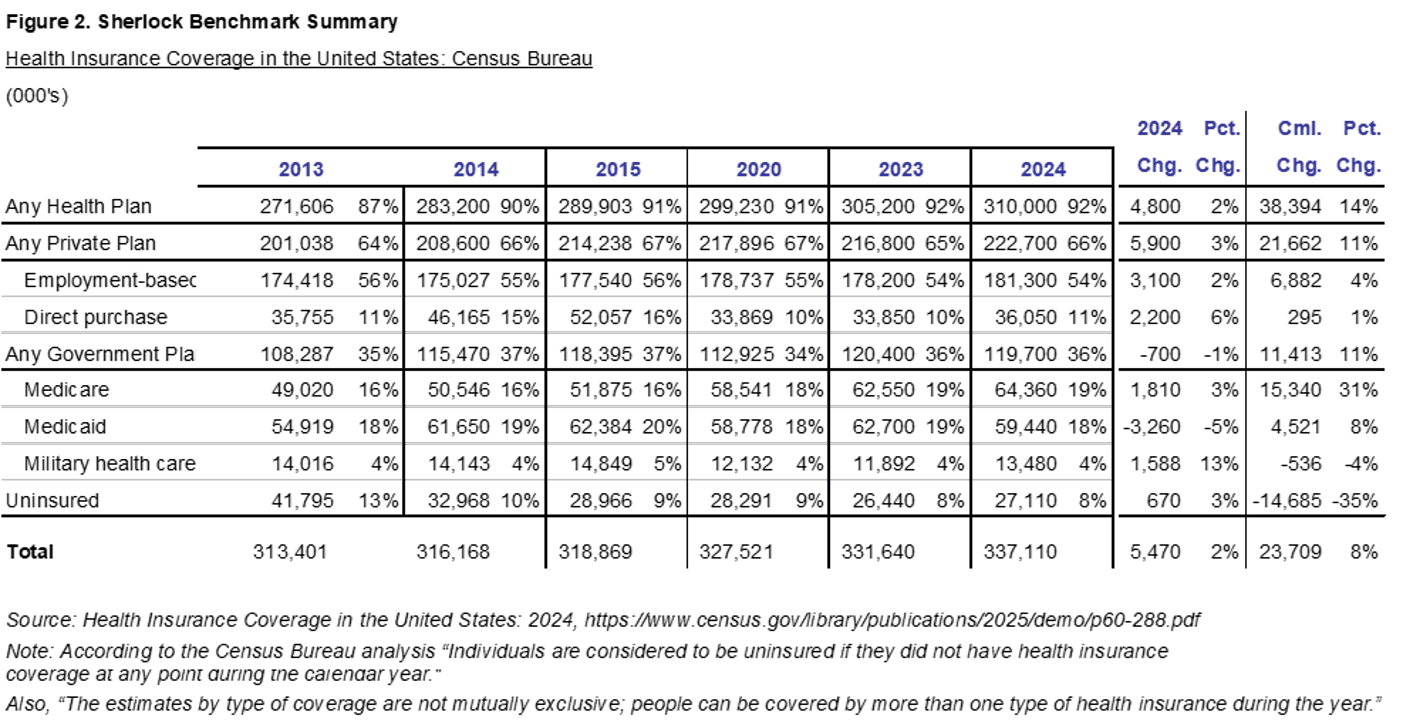

Figure 3 shows year-over-year trends on both an as-reported and constant-mix basis. On an as-reported basis, for the eleven continuously participating plans, per member core costs grew by 8.3%, faster than last year's increase of 5.4%. The two columns labeled "as-reported" reflect per member trends in continuous plans. The two columns labeled "constant mix" reweight the product costs for the continuously participating plans so that their product mix is exactly the same in each of the two comparison years. By eliminating the effects of changes in product mix between comparison years, it provides what we consider a more accurate measure of cost growth.

Cost trends shifted towards higher cost products like Medicare, which grew faster than lower cost Medicaid. We would expect that this shift would result in faster growth on as-reported costs compared to the constant-mix basis. Median changes in Core expenses aligned with this expectation, with as-reported growth at 8.3% versus constant mix at a slower rate of 5.0%. Meanwhile, Total as-reported expenses grew by 8.5% compared to the slower constant-mix growth of 3.6%.

Membership in the relatively less expensive to administer Medicaid fell by a median and mean of 12.7% and 13.6%, respectively. Meanwhile, combined Medicare and SNP grew by a mean of 5.7% and median of 5.1%. Membership in Commercial products increased by a median of 2.4% and a mean of 5.7%. Within the Commercial segment, Insured outpaced the lower cost ASO product at a median of 8.4% and average of 11.8%. ASO's median and mean growth decreased by 0.1% and 1.1%, respectively.

For the core clusters in Figure 3, Medical and Provider Management increased by 7.9% on an as-reported basis versus 7.1% on a constant mix basis. Account and Membership's as-reported and constant-mix was 9.9% and 6.6%, respectively. Corporate Services cluster was higher by 8.5% on an as-reported basis versus 4.1% on a constant-mix basis. The pattern of growth, that is, as-reported exceeding constant-mix, in each of the Core clusters comported with the shift in the mix towards more expensive products, such as Medicare. Similarly, Sales and Marketing was also higher by 8.8% on an as-reported basis and marginally lower on a constant-mix basis, by 0.01%.

The eleven continuously participating plans served 4.2 million members in Medicaid CHIP and HMO. There were 856,000 members served under Medicare Advantage and SNP, while 113,000 served under Medicare Supplement. Commercial comprised 2.3 million members of which 996,000 was served under an ASO arrangement and 1.3 million were fully-insured. The eleven plans served 7.4 million members with these comprehensive products.

Trends Holding Product Mix Constant

Again, a trend analysis that eliminates the impact of product mix changes is, in our view, a more accurate representation of true trends so the discussion that follows is largely based on this. To make this calculation, we reweight the plans' product mix of the prior year to match that of the current year. Only those health plans that reported in both periods are compared.

Of the Core functions, Customer Services was the fastest growing function, while Information Systems was the most important source of growth. While not included in Core, Sales and Marketing cluster slightly offset Total cost growth with Advertising and Promotion being the fastest and most important source of this cluster's decline.

For Core functions, Median Non-Labor Costs per FTE and Medicaid Staffing Ratios were higher than last year. Conversely, propensity to outsource was lower. Trends in Staffing Costs per FTE varied. These metrics are calculated after converting outsourced staff, compensation and non-labor costs to internal equivalents. Staffing ratios are expressed holding product-mix constant: specifically, we will refer to Medicaid staffing ratios. (Medicaid staffing ratios are inferred based on the assumption that the labor / non-labor resource mix is the same for each product offered by the plans. In addition to being the staffing ratio of the greatest interest to Medicaid Navigator audiences, this convention overcomes ostensible differences in staffing ratios due to the effects of each plan's outsourcing practices and also assures comparability in staffing ratios between years.)

Medical and Provider Management

Holding constant the product mix, PMPM expenses in the Medical and Provider Management cluster grew by 7.1%. Growth was driven by higher Staffing Costs per FTE, Non-Labor Costs per FTE, and Medicaid staffing ratios were also higher.

Provider Network Management and Services grew at a faster pace compared to its counterpart function, Medical Management. However, due to its size, the increase in Medical Management was a more important source of growth for the cluster. Medical Management sub-functions that grew notably were Case Management, Health and Wellness, Medical Informatics, Utilization Review, and Other Medical Management. The Medical Management Staffing Costs and Medicaid Staffing Ratios were higher than the prior year as outsourcing declined.

The Provider Network Management and Services functional area grew faster than Medical Management. This function's Compensation per FTE and Medicaid Staffing Ratios were higher than the previous year. All of its higher sub-functions were higher, Provider Relations Services, Provider Contracting (as well as both of its sub-functions) and Other Provider Network.

Account and Membership Administration

The Account and Membership Administration cluster of expenses posted a median PMPM increase of 6.6%, on a constant-mix basis. The cluster's Medicaid Staffing Ratio for this cluster was higher than the prior year. Outsourcing and Non-Labor costs per FTE declined.

The most important source of this cluster's growth was Information Systems, on higher Compensation per FTE and Medicaid Staffing Ratios. Non-Labor costs per FTE declined. Subfunctions Operations and Support and Applications Acquisition and Development were both higher.

Customer Services was this cluster's fastest growing function mainly on higher Compensation, Non-Labor, and Medicaid Staffing Ratios. Propensity to outsource was also higher. The per member expenses of the subfunctions Member Services, Printed Materials, and Grievances and Appeals sub-functions were all higher than last year.

Claims costs increased at a high single digit rate. Staffing Costs, Non-Labor Costs, Staffing Ratios and Outsourcing were all up from last year. Payment Integrity was the only sub-function higher than last year, but it was sharply higher.

Enrollment / Membership / Billing cost was higher than last year with the Billing sub-function higher than the prior year. Both Medicaid Staffing Ratios and Outsourcing were higher than last year.

For the purposes of Navigator, we include Behavioral Health and Pharmacy administration in overall cost trends and those of Account and Membership Administration. If excluded from Account and Membership, the cluster would have increased by 5.9% rather than the 6.6% shown in Figure 3. If these activities had been excluded, Core administrative expenses would have increased by 5.2% rather than the 5.0% that we show in Figure 3. The PMPM Pharmacy and Behavioral Health administrative costs increased at a median rate of 6.8%.

Corporate Services Cluster

On a constant-mix basis, the PMPM Corporate Services cluster costs increased by 4.1% compared with 3.5% in the prior year. Compensation and Medicaid Staffing Ratios were higher than last year.

Actuarial was the fastest growing and most important source of growth for this cluster. Non-Labor, Medicaid Staffing Ratios, and use of outsourcing were up from last year.

Association Dues and License Filing fees, Finance and Accounting, and Corporate Services function followed Actuarial's growth. Conversely, the Corporate Executive and Governance was slightly lower than the prior year.

Sales and Marketing

While Sales and Marketing is not included in Core expenses, it is still central to Commercial and Medicare products that are also offered by these Medicaid-focused plans. Medicaid also can include such activities as health fairs and outreach that are similar to functions in this cluster. The Sales and Marketing cluster declined slightly by 0.01% PMPM, holding the product mix constant.

Advertising and Promotion was the sharpest decline and greatest source of decline for the Sales and Marketing cluster. Sales and Rating and Underwriting rates of decline followed. Conversely, External Broker Commissions and Marketing each increased year-over-year. Staffing Costs and Non-Labor increased.

As-Reported Trends

This section will focus on key trend differences in as-reported that notably vary from the constant mix trends. When a plan reports costs in sequential years, the changes in those costs reflect both real changes and the effect of changes in product mix. As noted earlier, the continuously reporting plans shifted in favor of higher cost products like Medicare so that Core and Total as-reported costs, on average, grew faster than when product-mix is eliminated.

In 2024, Core expenses PMPM increased on an as-reported basis at a median rate of 8.3% PMPM versus 5.0% for constant-mix. Every cluster grew faster on an as-reported basis compared to constant-mix.

Sales and Marketing costs, which are not considered to be Core in this universe, increased by 8.8% on an as-reported basis and compares to a 0.01% decrease on a constant-mix basis. This represented the greatest difference in clusters' rate of change between as-reported and constant-mix. All functions increased their growth on an as-reported basis led by External Broker Commissions, Marketing and Rating and Underwriting. Sales flipped from a decline to a slight increase on an as-reported basis, while the decline in Advertising and Promotion slowed. Rating and Underwriting, Marketing and Advertising and Promotion all increased at a double digit pace on this basis.

The Corporate Services cluster's costs increased by 8.5% on an as-reported basis, faster than the 4.1% increase on a constant-mix basis. The growth in all functions increased their rate of change led by Actuarial and Finance and Accounting, while Corporate Executive flipped from a decrease to an increase. Actuarial increased at a double-digit pace, as-reported and Finance and Accounting increased at nearly double digits.

The Account and Membership cluster posted faster as-reported growth, 9.9% versus 6.6%, on a constant-mix basis. All functions posted faster increases on an as-reported basis with Enrollment / Membership / Billing and IS experiencing the largest changes in as-reported growth versus constant mix.

Medical and Provider Management increased by 7.9% on an as-reported basis, faster than its constant-mix growth of 7.1%. The growth in Provider Network Management and Services grew slower on as-reported basis, while Medical Management's grew faster.

Summary of Cost Drivers

We think that it is helpful to understand functional expenses by their drivers. PMPM costs can be thought of as the product of the staffing ratio and total costs per FTE. The total costs per FTE is the sum of staffing and non-labor costs per FTE. The comments in this section are based on median values for the eleven continuously participating plans and includes staffing and costs performed on an outsourced basis.

The median Core Medicaid staffing ratio was higher by 12% to 21 FTEs per 10,000 Medicaid members. Of the 14 functional areas with staff (Core and Sales and Marketing), 11 posted increases from the prior year. (To be clear, this reflects both internal and outsourced staffing. Outsourced staffing is inferred, often calculated by the plans from invoice amounts using historical norms of total costs per FTE, then applied to the Medicaid product by assuming that all products have the same mix of staffing and non-labor costs.)

The median Core compensation per FTE decreased by 3% to approximately $107,000. (Note, the average Core compensation increased by 3% to $108,000.) For medians, only one functional area was lower than the prior year. For means, of the 14 functions with staff, 11 experienced increases from a year ago.

Propensity to outsource, at a median of 12% for Core, was about 1 percentage point lower than last year. Of functional areas with staff, five decreased their use of outsourcing.

Core Non-Labor Costs was $79,000 per FTE, higher by 6% over the previous year. Six out of the 14 functional areas with Staff increased in Non-Labor costs.

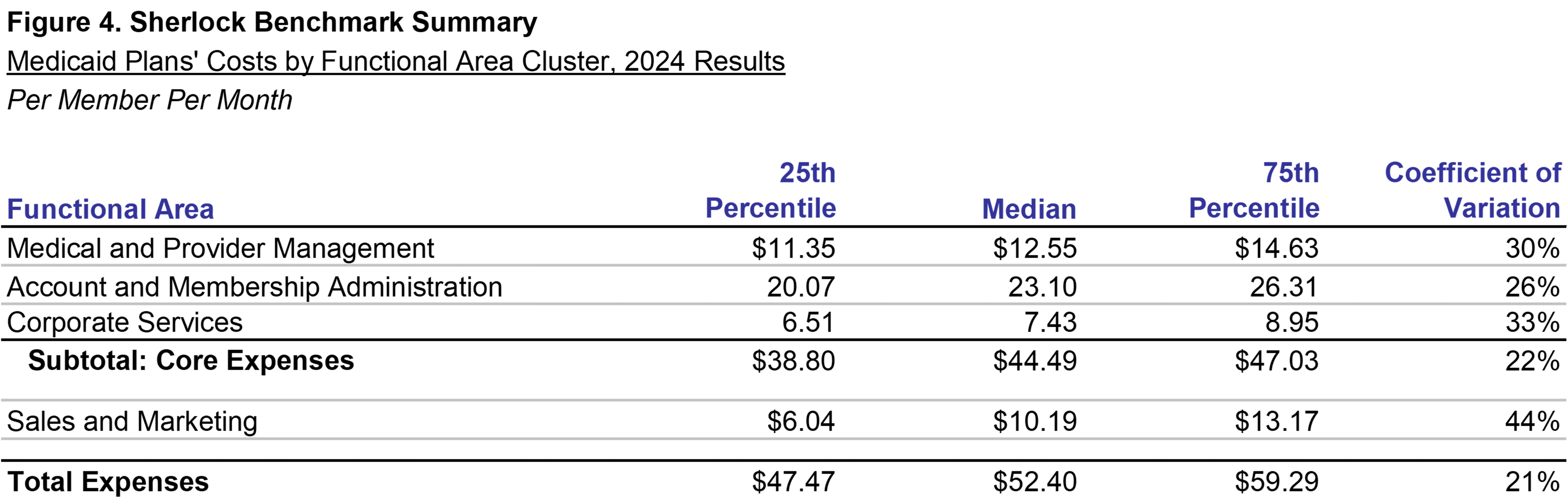

Costs of Medicaid-focused Plans, by Cluster, PMPM

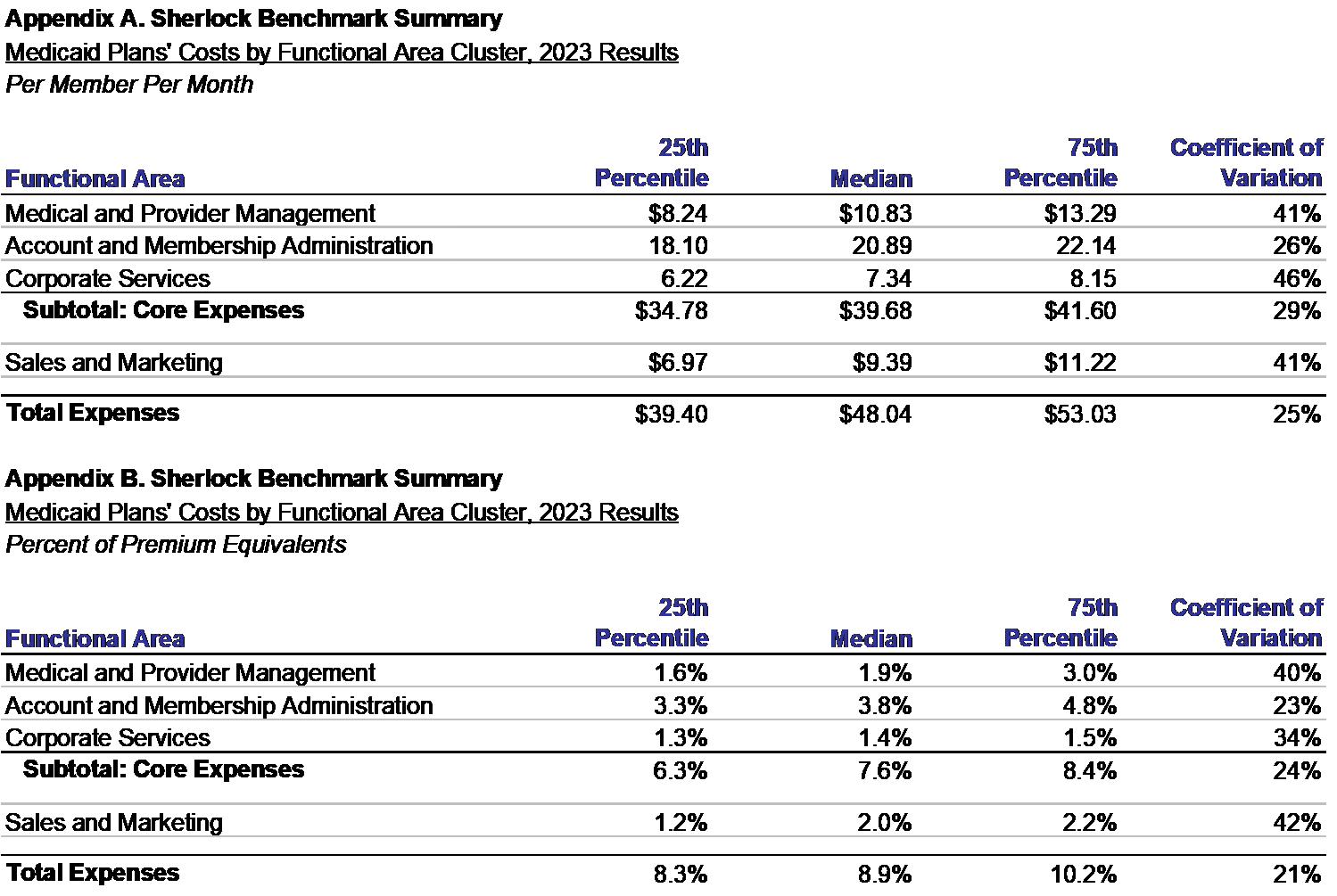

Figure 4 shows the values of administrative expenses for all 14 participating Medicaid-focused plans, as opposed to the 11 continuously participating plans in the prior discussion. This section touches on comparisons with the results reported last year, notwithstanding important limitations. The prior year's values are shown in Appendix A.

Bear in mind that this universe of Medicaid-focused plans differs from that of last year in product mix and in populations. No plans dropped out of the universe from a year ago, while there were three additions. Therefore, it is not possible to perfectly compare the performance of plans participating in this and last year based on Figure 4 and Appendix A. For the new plans, and the ones that only participated last year, we can know neither their trends or their changes in product mix.

Account and Membership Administration is the largest cluster of expenses. Comprised of activities central to health plan operations, it increased by 10.6% to a median of $23.10 PMPM, shown in Figure 4. The as-reported and constant-mix increases of 9.9% and 6.6%, respectively. This cluster includes Information Systems, Enrollment, Claims and Customer Services.

Medical and Provider Management costs per member per month was $12.55 PMPM, 15.8% higher than last year's value of $10.83. This cluster grew on an as-reported basis for the continuously participating plans by 7.9%, while increasing by 7.1% on a constant-mix basis. This group of functions includes Provider Network Management and Services and Medical Management / Quality Assurance / Wellness.

The Corporate Services cluster costs were higher PMPM than last year at $7.43 versus $7.34 last year, an increase of 1.2%. The Corporate Services cluster increased for plans participating in both years on both an as-reported basis and constant-mix basis by 8.5% and 4.1%, respectively. Activities include Corporate Executive, Actuarial, Finance and Accounting, and a group of other activities called the Corporate Services Function that include Facilities, HR and Legal.

Median Core administrative expenses were $44.49 PMPM, 12.1% higher than last year's median of $39.68. For plans participating in both years, as-reported and constant-mix growth in Core expenses was higher by 8.3% and 5.0%, respectively.

The Sales and Marketing cluster PMPM costs grew by 8.6% to a median of $10.19 PMPM. As-reported increased by 8.8%, while down slightly by 0.01% on a constant-mix basis. Sales and Marketing functional areas include Rating and Underwriting, Sales, Marketing, Broker Commissions and Advertising.

Median Total Expenses were 9.1% higher to $52.40 PMPM from $48.08 PMPM. For continuously reporting plans, as-reported costs increased 8.5% and constant-mix growth was 3.6%.

The dispersion in Core Expenses, measured by the Coefficient of Variation, decreased compared to last year. Corporate Services experienced the greatest decline, while the Coefficient of Variation also fell for Medical and Provider Management. Account and Membership Administration was slightly higher, as well as the Sales and Marketing Cluster. Total expenses also decreased its dispersion from last year.

Dispersion measured by the change in the difference between 25th and 75th percentiles widened for Core expenses. The differences between 25th and 75th percentiles also increased for Account and Membership and Corporate Services cluster, while Medical and Provider Management decreased. The differences increased for Sales and Marketing but narrowed for Total expenses.

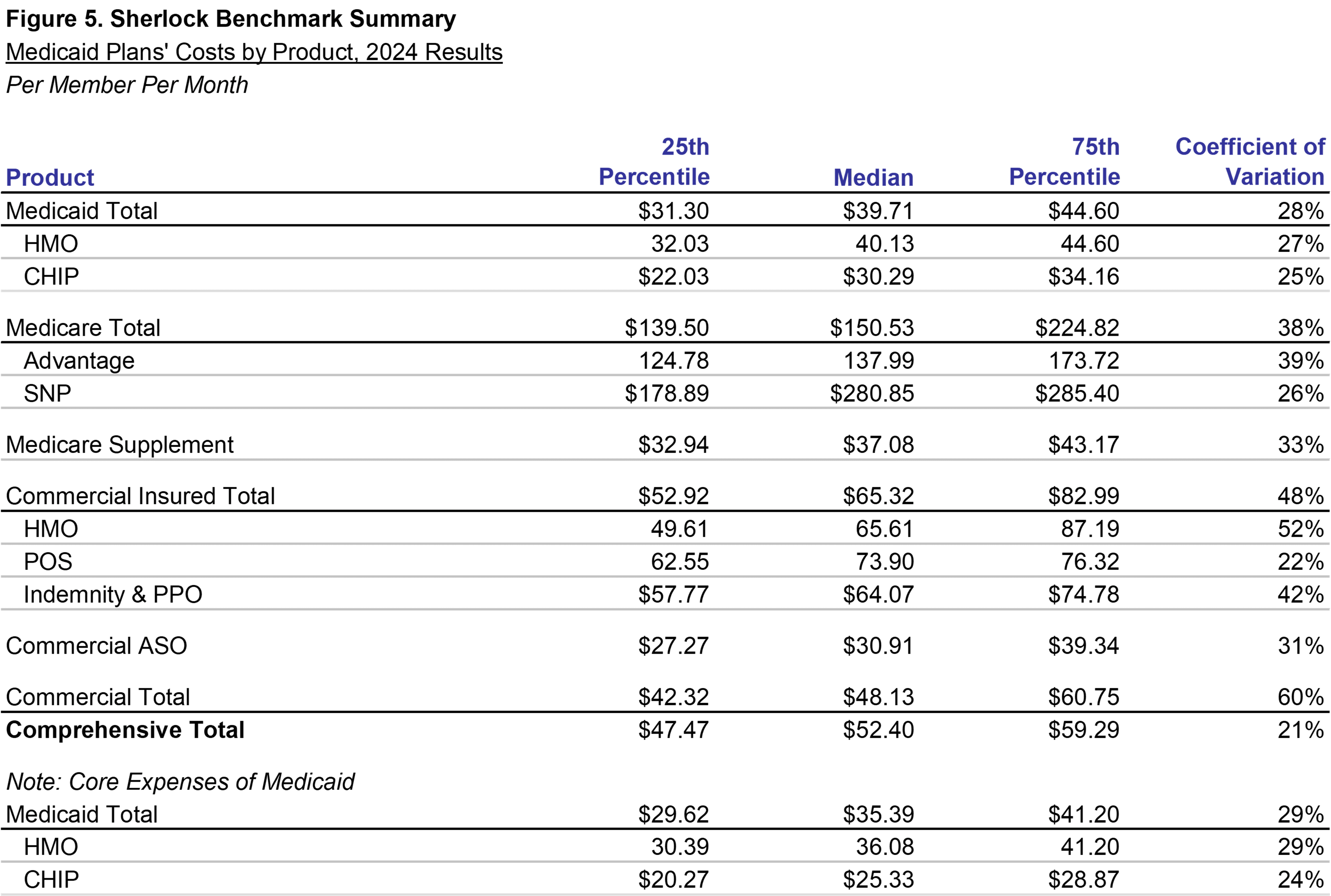

Costs of Medicaid-focused Plans, PMPM by Product

The importance of considering each product's costs when evaluating a health plan's administrative costs is shown in Figure 5. The products vary greatly in their per member costs. For this reason, when we report results we often reweight the universe product mix to eliminate effects of any differences between participants and its peers.

Figure 5 displays total expenses by product, which include Sales and Marketing, except for the note at the bottom of that figure pertaining only to Medicaid core expenses. Sales and Marketing activities are reflected in the Sherlock Benchmarks if they meet its definitions regardless of whether the specific activities are of a type allowable by the states. For instance, we include Risk Adjustment expenses in the Medicaid product costs as Sales and Marketing in this figure but not as a Core Cost, though this activity is universal by the participating plans.

Median expenses for Medicaid HMO was $40.13 PMPM and was $30.29 PMPM for Medicaid CHIP. For all fourteen participating plans, Total Medicaid's average mix of members was over 59% and its average mix of revenue was 48%.

Shown in the note at the foot of the chart, Per Member Per Month Core expenses for Medicaid HMO and CHIP combined was $35.39. Core Medicaid HMO was $36.08 and Medicaid CHIP was $25.33. Core expenses exclude Sales and Marketing costs. An estimate of the Sales and Marketing expenses associated with this product can be inferred as the difference between the footnote and the body of this figure.

Medicare, like Medicaid, is government-sponsored products. Medicare products serve seniors as Medicaid serves low-income people, respectively. There is some overlap between them in the case of Medicare Special Needs Plans ("SNP") products, which have many members eligible for both programs.

Medicare products are relatively high cost at $280.85 PMPM for Medicare SNP and $137.99 PMPM for Medicare Advantage. The average membership mix for Medicare Advantage was 7% and Medicare SNP was 2%. Average revenue mix for Medicare Advantage was 13% and Medicare Advantage SNP was 4%.

Note that Medicare Supplement has lower costs than the median for comprehensive total at $37.08 PMPM. We include this as a comprehensive product in the Sherlock Benchmarks though it pays only when Medicare does not. Four plans in the Medicaid universe offer the product and its mean product mix was 2% and revenue mix was 1%.

Commercial administrative expenses are both higher and lower than the median comprehensive total. The costs of Commercial Insured products are accordingly higher than the median for comprehensive products. This bifurcation depends on their financing mechanism and indirectly bears on group size. An ASO group possesses the statistical advantages of larger size, which also means that their Sales and Marketing costs are spread among greater numbers of members. Because of the modest per member Sales and Marketing expenses required for large groups, ASO products have a median cost of $30.91 PMPM.

The single most important Commercial Insured product for this universe is HMO at $65.61 PMPM. POS costs $73.90 PMPM, while Indemnity and PPO costs $64.07.

The mean mix of Commercial products was 31% of the membership: Commercial Insured and ASO each served 18% and 13% of total membership in this universe, respectively. Median Commercial Total costs PMPM were $48.13.

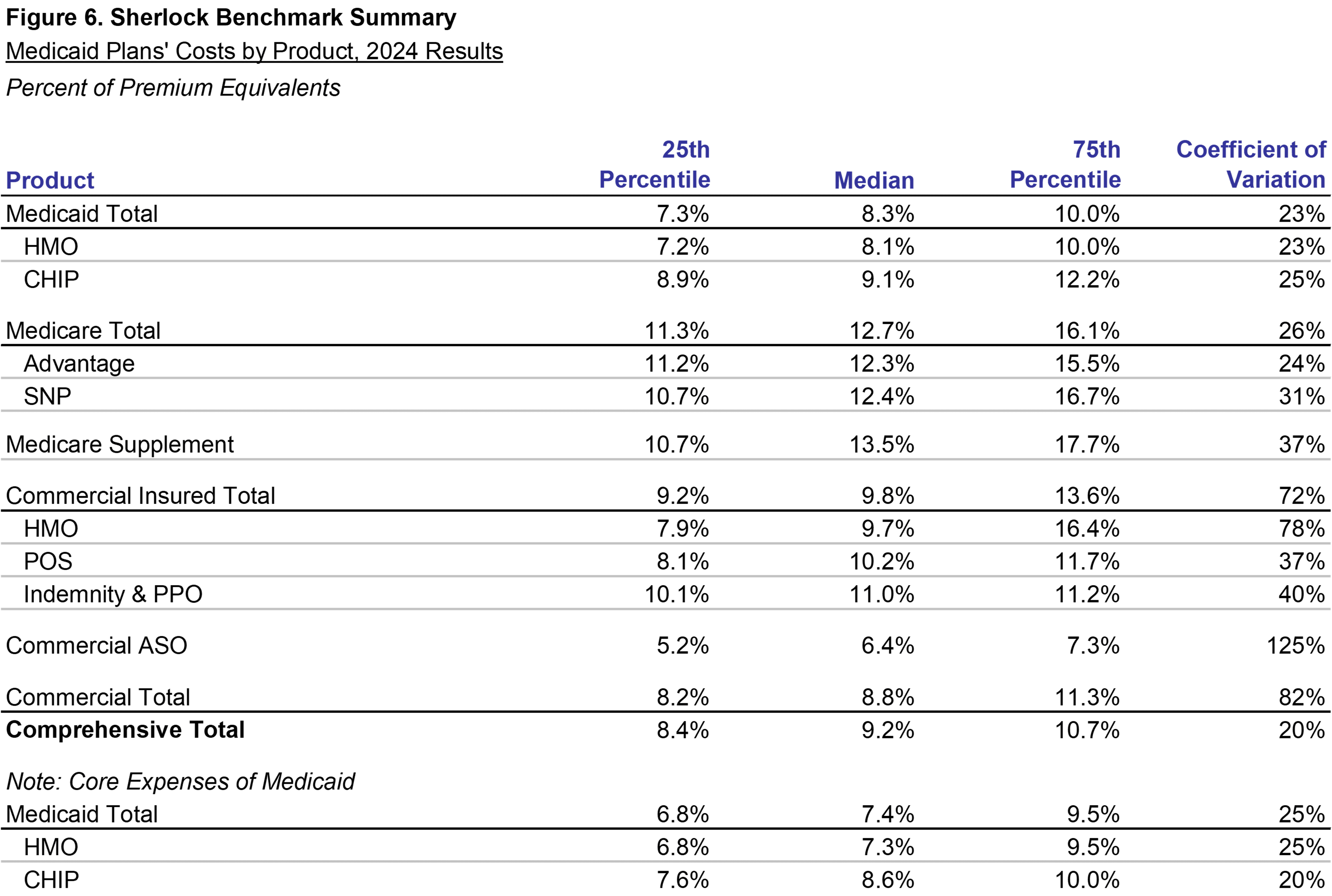

Costs of Medicaid-focused Plans, Percent of Premiums by Product

The ranking the various products' administrative expenses by the percent of premiums is generally similar to the ranking of the PMPM costs. Often, administrative activities correspond with the health care needs of the population each product serves. On average, the administrative costs of Comprehensive products were 9.2% of premiums.

The percent of premium ratios used here are calculated based on premium equivalents for Commercial ASO products. This is not GAAP, of course, but enhances comparability between the self-insured and fully-insured products.

Both Medicaid HMO and Medicaid CHIP were lower than Comprehensive Total on both a PMPM and percent of premium basis, at 8.1% and 9.1%, respectively.

Medicare SNP, the highest cost product on a PMPM basis, is higher than most products on a percent of premium basis at 12.4%, but this difference relative to other products is far smaller than on a PMPM basis. Meanwhile, Medicare Advantage expenses, while approximately two times greater than Commercial HMO Insured products on a PMPM basis, is narrowly higher on a percent of premium basis at 12.3%.

While Medicare Supplement is below comprehensive total when measured on a PMPM basis, at 13.5%, its cost ratio was greater than that of the Comprehensive total.

Administrative expenses on a percent of premium basis for Commercial HMO and POS were 9.7% and 10.2%, respectively, while Indemnity and PPO was 11.0%. These ratios, like the PMPMs, were higher than Comprehensive total of 9.2%.

Administrative expenses of Commercial ASO products are 6.4% on a premium equivalent basis. It is also relatively low cost when measured on a PMPM basis. The lower Sales and Marketing for self-insured groups is key reason for this difference. The median value for administrative costs as a percent of premium equivalents for all Commercial products was 8.8%.

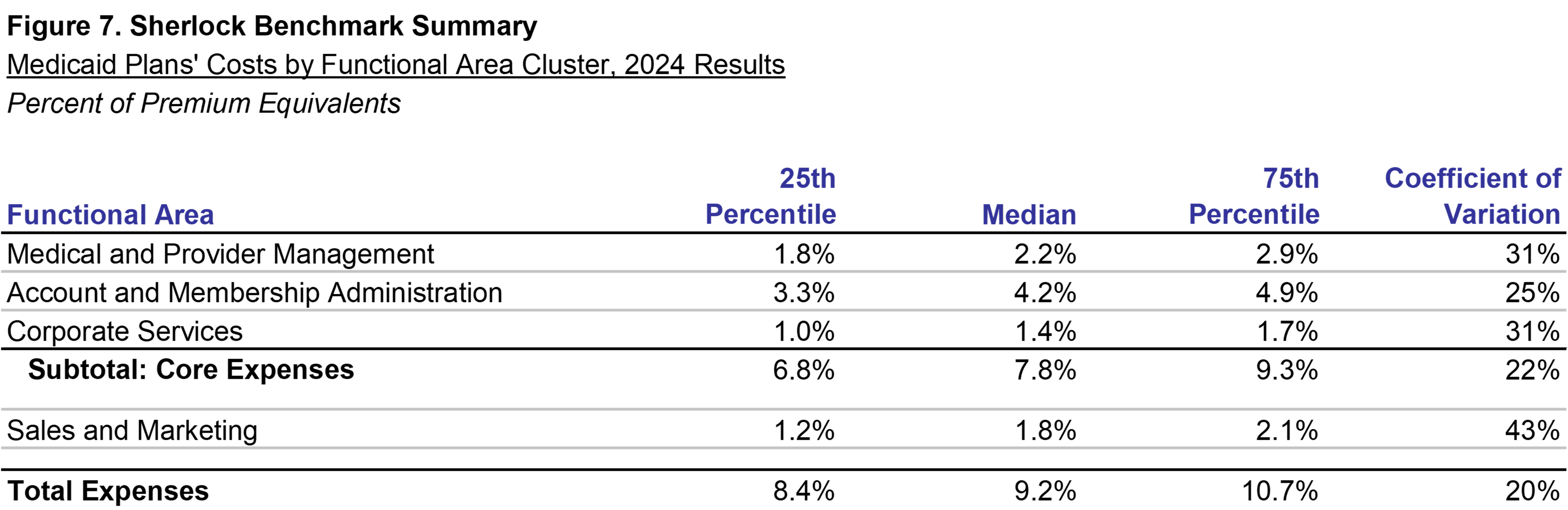

Costs of Medicaid-focused Plans, Expense Clusters as Percent of Premium

Figure 7 shows the ratios of administrative expenses to premiums or equivalents for Medicaid plans' expense clusters. Core administrative expenses increased by 0.2 percentage points to 7.8% compared with last year's median of 7.6%, shown in Appendix B.

Account and Membership Administration increased by 0.4 percentage points to 4.2%, while Medical and Provider Management was higher by 0.3 percentage points to 2.2%. Corporate Services cluster was relatively flat at 1.4%.

Sales and Marketing decreased by 0.2 percentage points to a median of 1.8%. Total expenses, including Sales and Marketing, had a median percent of premium of 9.2%, 0.4 percentage points higher than the prior year.

Comparisons Across Universes

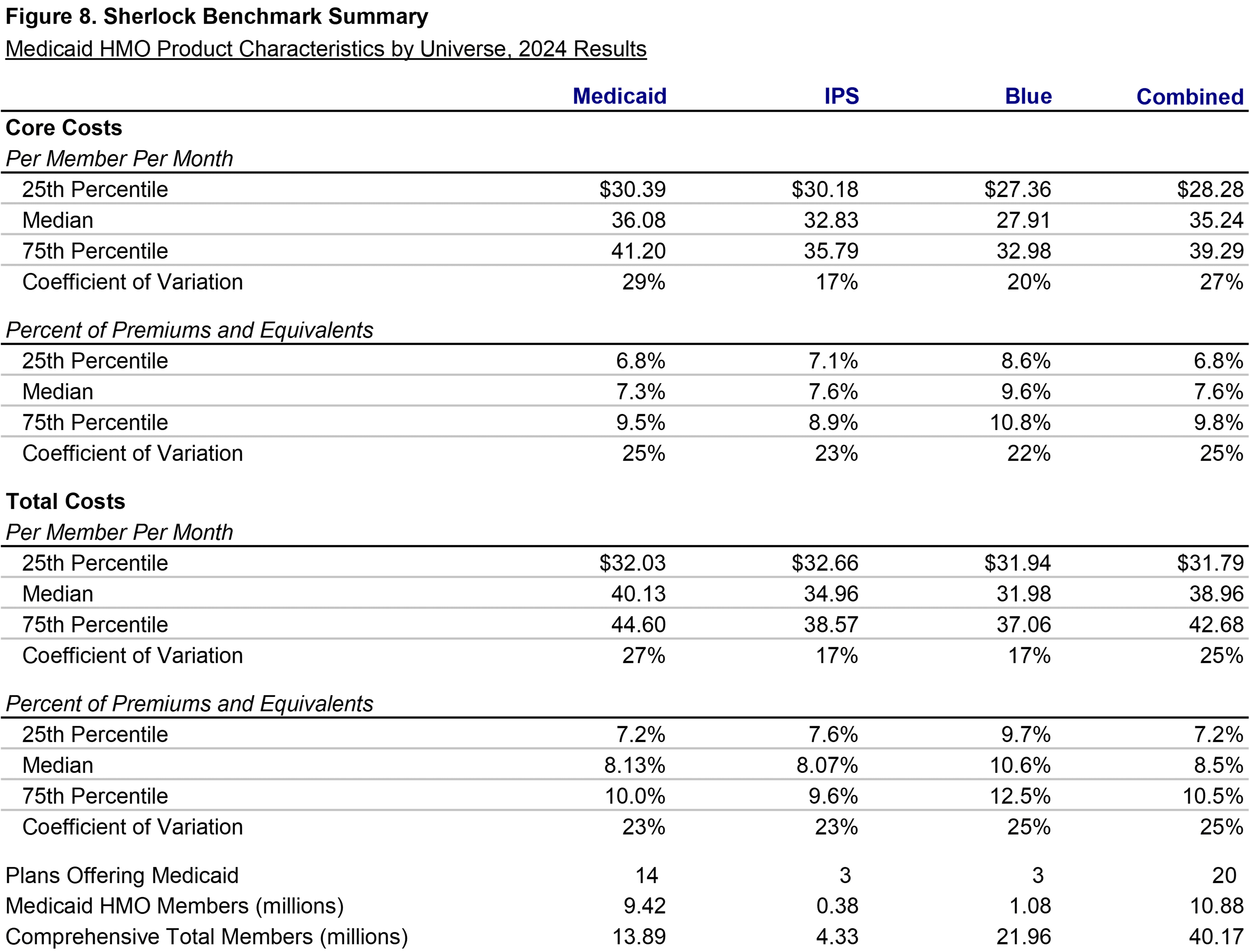

Health plans in other Sherlock Benchmark universes also offer Medicaid products. In this section, we compare the results of Medicaid HMOs offered by Medicaid-focused plans to this same product offered by Blue Cross Blue Shield Plans and Independent / Provider - Sponsored plans. We define "focused" to be those plans that have a disproportionate commitment to the Medicaid product. The median mix of members from Medicaid HMO products for the Medicaid-focused plans was 61%.

Since the product and cost definitions are the same, it is possible to directly compare Medicaid HMO products offered by our Medicaid universe with similar products offered by the Blue Cross Blue Shield and Independent / Provider - Sponsored universes. Combining all the universes, these plans collectively serve 10.88 million Medicaid HMO members or over 18% of all Medicaid beneficiaries. Expressed on a PMPM basis, the Medicaid-focused plans have higher costs while, on a percent of premium basis, they tend to have lower costs.

Shown in Figure 8, the comparison of Medicaid costs for the Medicaid, Blue Cross Blue Shield, and Independent / Provider-Sponsored universes. Blue Cross Blue Shield Plans Median core administrative costs were $27.91, lower by $8.17 PMPM compared to the Medicaid plans. On a Per Member Per Month basis, Independent / Provider - Sponsored plans' Medicaid Core costs were $32.83, $3.25 PMPM lower than those in Medicaid-focused plans.

Similarly, IPS Total administrative expenses of $34.96 PMPM, which includes Sales and Marketing, were $5.17 lower than that of Medicaid focused plans. Blue Cross Blue Shield Plans had Total median expenses of $31.98, lower by $8.15 versus the Medicaid plans.

Calculated on a percent of premium basis, Blue Cross Blue Shield Plans' Core administrative expenses, at 9.6% of premiums, were 2.2 percentage points higher than those of Medicaid focused plans. Based on Total expenses, Blue Cross Blue Shield Medicaid administrative expenses were 10.6%, higher than those of the Medicaid plans by 2.5 percentage points.

Compared to Independent / Provider - Sponsored Plans when analyzed on a percent of premium basis. IPS plans' core costs were higher by 0.2 percentage points, 7.6% versus 7.3%. IPS plans' total administrative costs were slightly lower on a percent of premium basis by 0.1 percentage points, 8.07% against 8.13% for the Medicaid focused health plans.

Methodology

This analysis is based on the twenty-third annual edition of our performance benchmarks for Medicaid-focused health plans. The Sherlock Benchmarks (Sherlock Expense Evaluation Report or SEER) represent the cumulative experience of over 1,000 health benefit organization years.

Each peer group in the Sherlock Benchmarks is established to be relatively uniform. So, within that constraint, it is open to all Medicaid-focused plans possessing the ability to compile high-quality, segmented financial and operational data. This analysis of Medicaid plans is based on a peer group of fourteen plans who collectively served 13.8 million people in comprehensive products. Eleven of this year's participants also participated in the prior year.

The average plan participating in the Medicaid-focused Sherlock Benchmarks this year served 992,000 people under comprehensive products and the median membership was 668,000. The geographic reach of this universe extended from coast to coast.

Medicaid HMO and CHIP combined for 9.7 million members and composed 70% of the combined comprehensive membership and 62% of revenues for comprehensive products. The average Medicaid revenue and membership proportion was 48% and 59%, respectively.

Twelve out of fourteen plans served at least one type of Medicare product, Medicare Advantage or Medicare SNP. The average Medicare revenue and membership proportion was 17% and 8%, respectively. There were about 1.2 million Medicare members served by these plans.

Of all comprehensive members, 21%, or 2.9 million, were served through a commercial product. Approximately 996,000 were served under some form of self-insurance arrangement, comprising 34% of total commercial members.

The panel of plans that participated in the Sherlock Benchmarks for Medicaid plans was formed in the Spring of 2025. Survey materials were distributed to the participants in the first week in June and completed surveys were received back to us beginning in July. Sherlock Company performed a number of validation procedures with the active collaboration of the participating plans. Sherlock Company's compilation and report publication (including company specific summaries) followed in September.

Reporting Conventions

We employ some conventions to make the metrics most beneficial for the audience of Plan Management Navigator.

The trends reported in this analysis are median changes and, when we refer to PMPM or percent of premium ratios, these too are medians. This measure of central tendency reduces the effect of outlying values on overall trends and values. Since each median value is calculated independently, the components cannot be summed.

References to growth rates hold the universe constant in the comparison years unless otherwise noted. Rates of change called "as-reported" are of health plans participating during both comparison years. When we refer to "constant mix" we are calculating rates of change for that same constant set of Plans after reweighting each Plan's product costs to eliminate the effect of product mix differences between their years.

Percent of premium ratios are calculated on a premium-equivalent basis. That is, in the case of ASO/ASC arrangements, we synthesize premium rates by adding to fees the health benefits incurred by the self-insured group. In this way, premium equivalents sum to all of the expenses of health insurance, including profits earned by the health plan, analogous to actual premiums on insured products. While not in accordance with GAAP, this approach has two advantages: comparability of ASO/ASC ratios with those of insured products offered by these Plans, and an intuitive appeal to general readers.

Expenses and revenues exclude capital costs and investment income. We specifically exclude interest and similar debt capital costs, profits and capital formation costs (debt or equity) such as transaction costs, and interest payments to providers under "prompt pay" laws.

Participants in and licensees of the Sherlock Benchmarks will note that the values for Account and Membership Administration and Total Administrative costs reported here will differ from those reported in the Benchmarks. The values reflected in Navigator include administrative expenses associated with pharmacy and behavioral health while the Sherlock Benchmarks do not. Because of variation in contracting by employers for these benefits and that the administration of these health services is sometimes outsourced by Plans who accept these management responsibilities, the Benchmark reports carve them out. Pages 24 - 26 in Tab 2 of Volume I of the 2025 Sherlock Benchmarks reconciles these two presentations.

Miscellaneous Business Taxes are a special case among administrative expenses since, short of recapitalization or elimination of commercial insured business, such expenses are impossible to manage. So, expense trends, along with the PMPM and percent of premium ratios, are calculated before the effect of Miscellaneous Business Taxes.

Appendix A

Appendix B