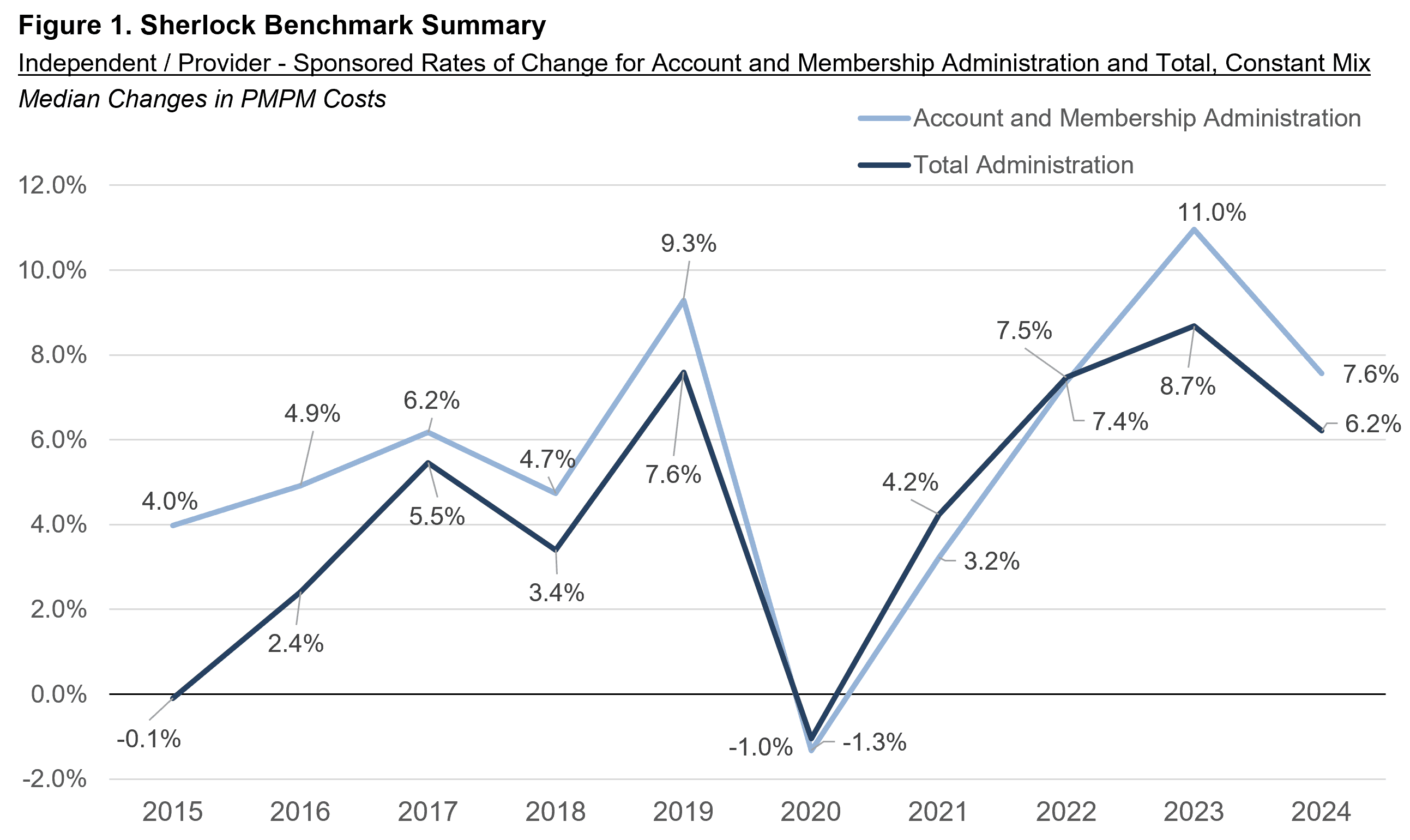

Independent / Provider – Sponsored Plans posted a sharp decline in PMPM expense growth, to 6.2% in 2024 from 8.7% in 2023, after adjusting to eliminate the effect of product mix differences. This growth was above the 10-year average growth of 4.4%. Similarly, the growth in the cluster of Account and Membership Administration (representing 40% of all expenses) also declined to 7.6% from 11.0%, greater than the 10-year average growth of 5.7%. This was partially masked by a change in product mix favoring more expensive products, so without adjusting for product mix, cost growth declined more slowly, to 9.5% from 10.5%.

As shown in Figure 1, the prior year's 8.7% for Total administration, exceeded the pace of 2019, as also was the 11.0% increase for Account and Membership Administration. 2021 through 2023 had repeated acceleration from declines in 2020, which declines we attribute to an adaption to Covid policies. The 2020 decline preceded by one year the growth decline by Blue Cross Blue Shield Plans. The post-Covid peak for Blue Cross Blue Shield Plans was also one year earlier, in 2022 rather than 2023 for IPS plans.

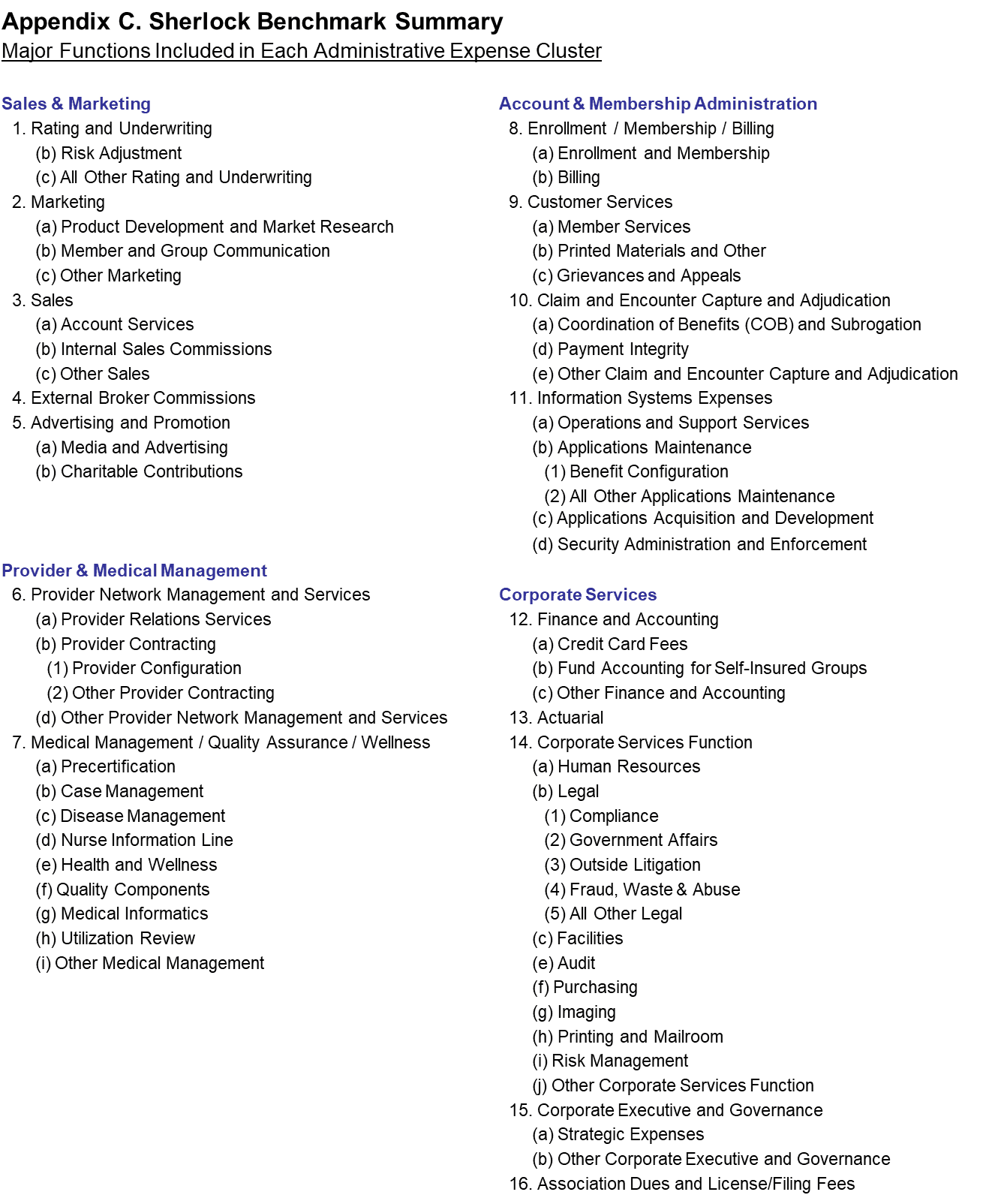

This Plan Management Navigator summarizes several themes evident from the plans' cost trends. Except for Rating and Underwriting, all Sales and Marketing functions decelerated and two of those function costs declined. By contrast, the plans emphasized Customer Services, Actuarial and Rating and Underwriting. There was also notable growth in Information systems, and acceleration in Medical Management. Some of Rating and Underwriting and Actuarial growth may be related to shift in favor Medicare and away from Medicaid. Overall, this product mix shift increased apparent expense growth.

The source of the data used in this analysis is Sherlock Company surveys of 12 Independent / Provider – Sponsored health plans. The 12 participating plans served 8.7 million people with Comprehensive products. Trends reported here are based on the results of the 10 continuously participating plans in the Sherlock Benchmarks.

Trends and Product Mix Changes

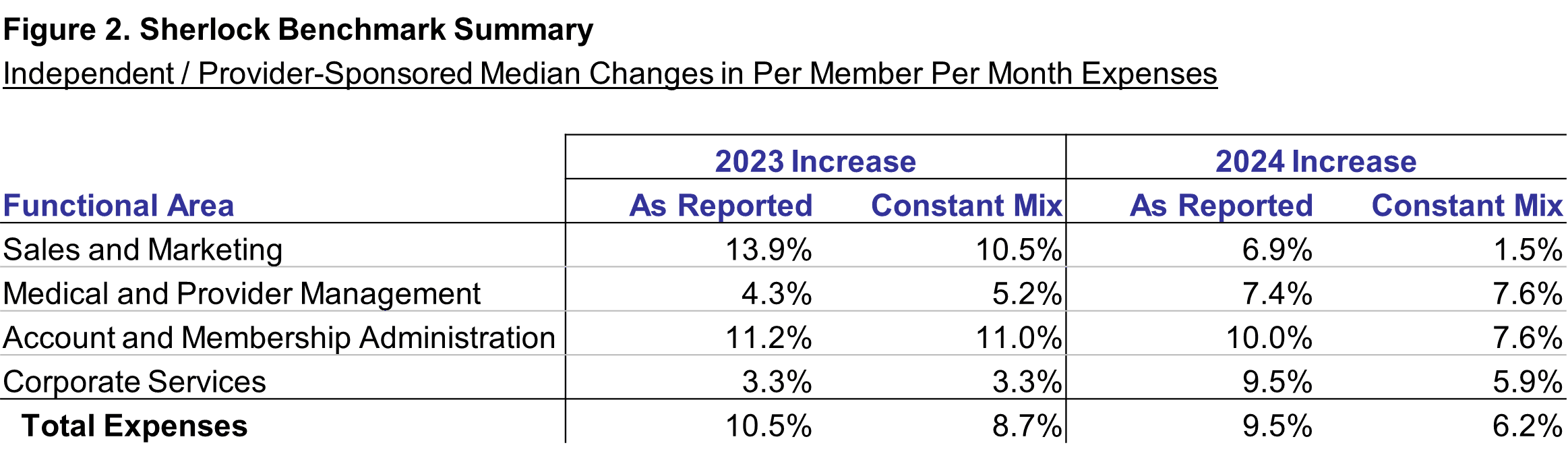

Figure 2 shows median year-over-year trends in total administrative expenses and in each cluster of expense. In all cases, trends are shown solely from continuously participating plans, and all trends are of costs per member per month. The "as reported" values are trends in PMPM costs. "Constant mix" values are also trends in costs but, in calculating growth, prior year product costs are reweighted to match this year's product mix.

Both Total expenses and, constant mix expense growth declined. The difference in trends reflected the effect of sharp growth in Medicare Advantage and decline in Medicaid. Per member constant mix administrative costs increased by 6.2% as against 9.5% as reported. We consider constant mix growth to be a more reliable way of looking at expense trends.

Excluding the effect of changes in mix, there was a sharp decline in total expense growth among continuously participating plans, from 8.7% growth to 6.2%, 2.5 percentage points. Growth rates in Sales and Marketing and Account and Membership Administration declined while Medical and Provider and Corporate Services each accelerated.

Without adjusting for changes in product mix, the decline in growth was only 1.0 percentage points. Again, only Sales and Marketing and Account and Membership Administration declined. The declines in Sales and Marketing were steepest among the four clusters of expenses.

The 3.2 percentage point lower rate of growth in Total expenses on a constant mix basis compared with on an as reported basis implies a shift in favor of more expensive products. Among all plans surveyed, approximately 20.8% of all IPS revenues was Medicare Advantage, up from 19.2% in 2023. The proportions for plans' Medicaid is 18.7% versus 23.8% in 2023.

Cost Trends Holding Product Mix Constant

In our view, trends that have the same plans in both comparison years and exclude mix changes are a more accurate representation of real trends in administrative costs. So the trend discussion in this Navigator emphasizes this approach.

Total expenses increased at a median rate of 6.2% compared with 8.7% last year. The effect of Pharmacy and Behavioral Health, included in the Figure 2 presentation, was to increase the rate of growth by 0.0% on a Constant Mix Basis and 0.3% on an as reported basis.

As shown in Figure 2, the growth in administrative expenses in 2024 was lower than in 2023. Sales and Marketing and Account and Membership Administration decelerated as Medical and Provider Management and Corporate Services accelerated. Key functions that contributed to expense growth were Information Systems Expenses, Medical Management / Quality Assurance / Wellness, Corporate Services, External Broker Commissions and Customer Services. The sharp decline in Advertising and Promotion was the greatest offset to growth.

Account and Membership Administration

Among clusters, the most important source of expense growth was Account and Membership Administration. Account and Membership Administration was the second fastest growing cluster of expenses. Costs increased in this cluster by 7.6%. It decelerated from 11.0% in 2023. Staffing surged as compensation growth exceeded inflation. The effect of Pharmacy and Behavioral Health, included in the Figure 2 presentation, was to increase the rate of growth by 0.7% on a Constant Mix Basis and 0.5% on an as reported basis.

Most of that cluster's increase arose from Information Systems' increases. Staffing Ratio surged at a double-digit pace after adjusting for mix. Compensation increased in line with inflation as non-labor declined possibly due to higher staff. Outsourcing declined. Growth approximated that of the prior three years.

Customer Services was the fastest growing function for this cluster and also compared with every other function. Its growth was the fastest in at least the last five years. Its increase was the second most important in its cluster. Its staffing ratio increased at a high single-digit rate and outsourcing increased. Compensation increased well above inflation.

Medical and Provider Management

The Medical and Provider Cluster of expenses grew at a similar pace to Account and Membership Administration, 7.6%. However, it accelerated from 5.2% in 2023. As a smaller function, contributed less to total expense growth but was the second greatest contributor to growth. Staffing ratios increased, compensation growth exceeded inflation and outsourcing declined slightly.

Medical Management's impact on this cluster's growth was vastly greater than the cluster's other function, Provider Network Management and Services, because of its greater size and far faster growth. In general, staffing ratios declined, while compensation growth exceeded inflation. Non-labor cost growth accelerated trends as outsourcing declined. The subfunctions of Utilization Review, Medical Informatics and Health and Wellness grew especially rapidly.

Corporate Services Cluster

The Corporate Services cluster is the smallest but it too accelerated to 5.9% from 3.3% growth in 2023. The staffing ratio increased slightly, compensation increased faster than for any other cluster, outsourcing was essentially unchanged as trends in non-labor reduced expense growth.

The impact of the Corporate Services function growth on cost increase exceeded that of all other functions in this cluster. While staffing ratios declined, notably in Legal and Human Resources, compensation in these subfunctions also grew greater than inflation. Non-labor costs increased and outsourcing was effectively unchanged.

Actuarial was by far the fastest growing function in this cluster. While its staffing ratio declined, both non-labor and outsourcing increased.

Finance and Accounting grew more rapidly than its cluster. Staffing ratios increased and staffing costs per FTE increased at a high-single digit pace. Outsourcing increased slightly.

Sales and Marketing

The Sales and Marketing cluster of functions showed the lowest increase, of 1.5% compared with 10.5% in 2023. Growth was slowest at least since 2020. Uniquely among clusters, staffing ratios declined. Compensation grew slower than inflation and non-labor expenses were down. Outsourcing increased.

The most important reason for this decline in growth is a double-digit percent cost decline in Advertising and Promotion, the only decline in the past five years. Non-Labor costs per FTE declined at high double digit rates.

While the Sales function also declined, Broker Commissions increased somewhat lower than the overall expenses. While per FTE Sales Compensation increased, the sales staff had a decline in FTEs. Both outsourcing and non-labor declined.

It should be noted that each of these plans operates with a different management approach depending in part on their individual market circumstances. For instance, one plan may choose to achieve the same efficiencies through Provider Contracting as another achieves using Medical Management so the trends described in measures of central tendency may not capture this nuance.

Growth and Product Mix

The effect of the change in mix among the continuously participating plans was that the typical member served became more expensive to administer, leading to higher growth in administrative expenses on an as reported basis than on a constant mix basis. In particular, the expensive to administer Medicare Advantage segment increased as Medicaid declined.

The median growth in Medicare Advantage was 6.0% as Commercial Total increased by 0.7%. There was also a sharp decline in Medicaid, by 12.7%. Somewhat offsetting this was growth of less expensive sub-products within those product categories: ASO growth of 2.9% exceeded 0.7% Insured for Commercial; SNP decreased by 3.3% as MA increased by 6.1%; CHIP increased as other Medicaid HMO declined. But the general effect of the mix shift among the continuously participating plans was a population that was more expensive to serve.

Commercial membership dominates the product portfolio of Independent / Provider – Sponsored plans with a 2024 mean mix of 63.2%. Fully-insured was the greatest choice among IPS commercial customers with a mean of 35.3% of total membership: Self Insured or ASO was 27.9%. ASO products' costs are lower than for comparable insured products largely due to the comparatively modest per member Sales and Marketing expenses required for large groups that are eligible to use these products. An ASO group necessarily possesses the statistical advantages of larger size in bearing the medical cost variance risk: this also means that group Sales and Marketing costs are spread through greater numbers of members.

HMO was the dominant commercial insured product at 22.2% with Indemnity and PPO at 10.3% and POS at 7.7%.

Medicare Advantage comprises a mean of 10.7% of Comprehensive members. SNP and MA are 0.5% and 10.2% respectively.

The Medicare Supplemental product has a mean share of 2.8% of Comprehensive membership. This low cost to administer product declined by 1.2% in its membership. The mean proportion of Medicaid members was 23.2%. It is offered by 9 of the plans and it exceeds 30% in four of them.

As Reported Trends

The focus of the following comments concern differences in cost changes between the two sets of calculations that may be explained by the effect of mix changes, in addition to the underlying cost growth. As with constant mix changes, the increase was lower than last year, 9.5% versus 10.5%. The as reported administrative expense growth was faster than the Constant mix growth. Figure 2 shows that the overall cost growth, on an as reported basis, was 9.5% PMPM, 3.2 percentage points greater higher than the constant mix growth of 6.2%. All clusters grew faster on an As reported basis than on a constant mix basis except Medical and Provider Management.

As noted above, the lower constant mix growth reflected the effect of the more rapid growth in products that are more costly to administer, especially Medicare Advantage. Also, low cost products such as Medicaid declined in membership. The effect of this was diminished by faster growth in lower cost Commercial segments: ASO grew faster than Insured among Commercial.

Sales and Marketing and Account and Membership Administration grew more slowly than the prior years, while Medical and Provider and Corporate Services increased more rapidly.

Sales and Marketing. As reported Sales and Marketing expense growth was the greatest difference from constant mix, at 5.4% greater, to 6.9%. The decline in Medicaid, with very limited Sales and Marketing, and the increase in heavily-marketed Medicare Advantage is a possible explanation. As reported Rating and Underwriting had a nearly 10 percentage point growth advantage from the constant mix growth. Risk Adjustment is an important expense of Medicare Advantage but is tiny for Medicaid. While Advertising and Promotion declined less in this rendering of trend, the decline was still in high single digits. This function was the greatest source of cost difference between the constant mix and as reported increase for this cluster and among all other expenses as well.

Account and Membership Administration. Account and Membership Administration also grew faster as reported 10.0% versus 7.6% on a constant mix basis. Each of the functional areas grew faster, most notably Enrollment / Membership / Billing. Enrollment expenses are much higher for Medicare than Medicaid.

Corporate Services. The Corporate Services cluster of functions grew faster on an as reported basis. The fastest growing and greatest change in growth from a constant mix basis is Actuarial function. At near double digits, it exceeded the growth rate in Customer Services.

Medical and Provider Management. Unique among the clusters, Medical and Provider Management increased slightly slower on an as reported basis, 7.4% versus 7.6%. Provider Network Management and Services grew faster on this basis while Medical Management grew slower. The lower increase in Medical Management was the second most important difference from as reported trends after Advertising and Promotion.

Trends in Factors Driving Costs

The operational drivers provide additional insights to cost trends. The drivers discussed in this section are estimated staffing ratios, compensation, non-labor costs and propensity to outsource excluding Behavioral Health and Pharmacy. We previously touched on their impact on some of the functions themselves.

The average staffing ratio increased by an average of 3.9% to a median of 27.2 Combined FTEs per 10,000 (This includes the effects of outsourced staffing, discussed later) and also 27.2 for Commercial Insured Members (both excluding Behavioral Health and Pharmacy). The median compensation was up by 3.4% to $123,000. Outsourcing increased by 0.3 percentage points, to a median of 12.1% of FTEs. Outsourced FTEs were increased by 0.3 percentage points and among continuous plans they have a median of 12.3% FTEs and an average of 11.7% outsourced. Information Systems and Corporate Services exceed this.

On a constant mix basis, staffing increased in all functions except for Sales, Medical Management, Enrollment, Actuarial and Corporate Services. Fast growing Medical Management and Actuarial had growth in PMPM non-labor costs, as also did Corporate Services.

Compensation growth was strong in Rating and Underwriting, Advertising and Promotion, Medical Management, Customer Services and Information Systems.

Costs of Independent / Provider-Sponsored Plans, by Cluster, PMPM

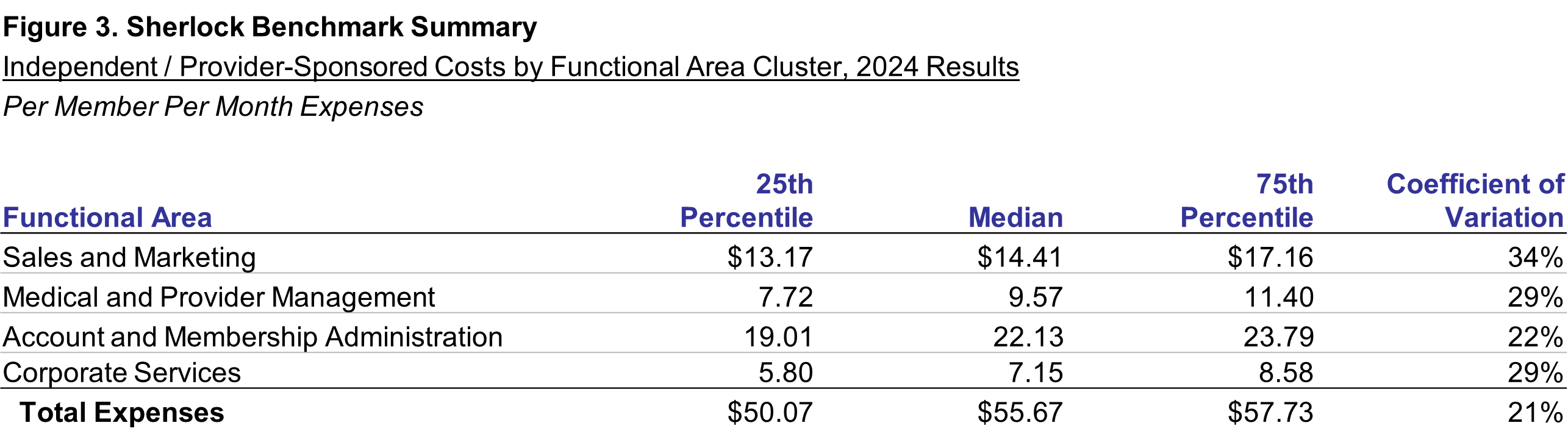

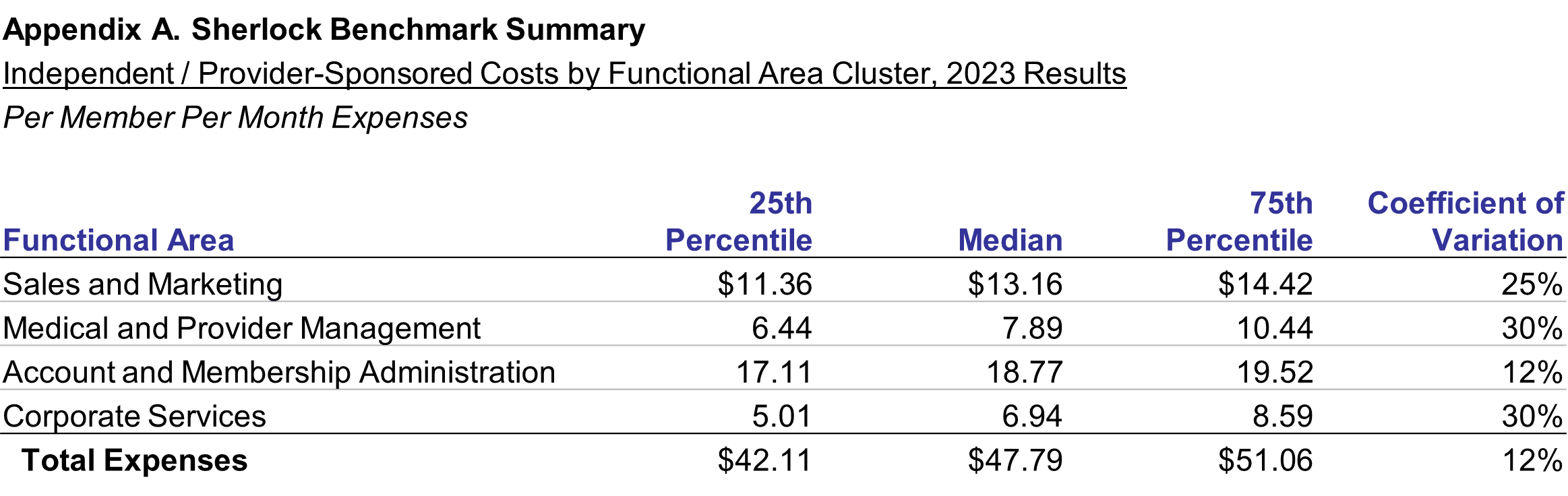

Figure 3 shows the median Independent / Provider – Sponsored Plan had total administrative expenses of $55.67 for all plans, 16.5% greater than the $47.79 reported last year. This was the result of expense growth in identical plans, holding products constant, of 6.2%, an additional 3.2% difference due to mix changes bringing growth to 9.5%, plus the effect of the deletion of two plans and addition of two plans, each with their own product mixes. The prior year values are shown in Appendix A. The changes shown in Figure 2 are a better measure of trend.

Medical and Provider Management had the highest increase, of 21.4% to $9.57. It was tied for the highest rate of growth on a constant mix basis. Account and Membership Administration was higher by 17.9% to $22.13 PMPM. Sales and Marketing was 9.5% above last year, $14.41 PMPM. The increase in Corporate Services was 3.1% to $7.15 PMPM.

The percent difference between 2024 has little apparent relationship with constant plan growth: the comparatively high growth in Medical and Provider Management and Account and Membership Administration is about all the similarity that can be claimed.

The coefficient of variation increased by 8 percent, while the difference between 25th and 75th percentiles decreased by $1.30 PMPM.

Costs of Independent / Provider-Sponsored Plans, PMPM by Product

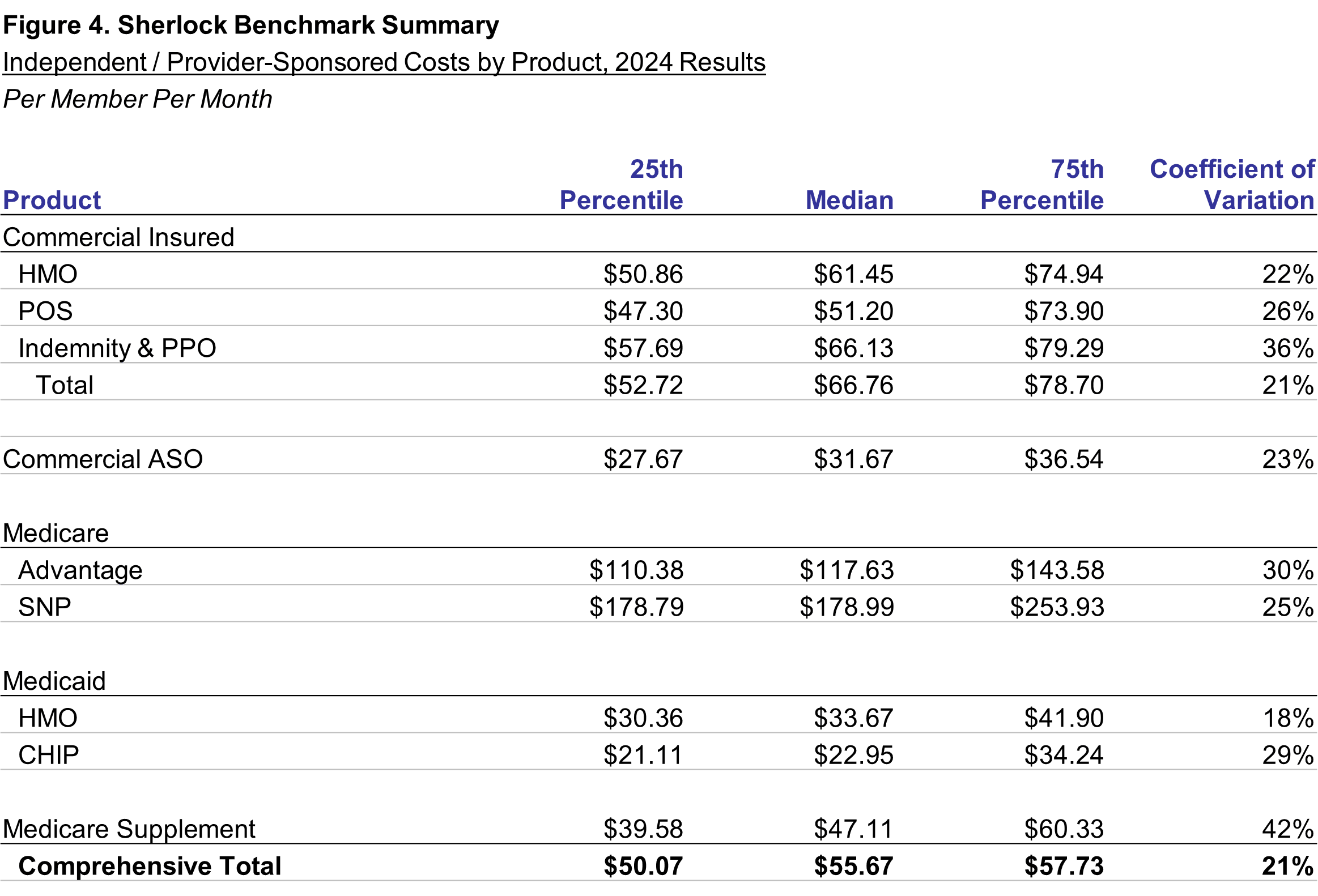

We have emphasized consideration of the product mix when considering the cost trends: we have given primacy to trends derived by reweighting prior year total costs by eliminating the effect of mix differences between any two comparison years. Figure 4 shows that, while PMPM expenses are $55.67 PMPM, the product costs are different, ranging from Medicaid CHIP at 22.95 to Medicare SNP at $178.99. We think these differences arise from factors of population requirements, characteristics of the benefit plan sponsor and the scope of benefits.

Population Requirements

Commercial Insured products range in median costs from $51.20 for POS to $66.13 for Indemnity and PPO. Commercial HMO Insured products sold by this universe were $61.45, and the median for all Commercial Insured products was $66.76.

Insured products have substantial marketing expenses, as do Medicare Advantage, and individuals represent significant portions of such members. The most important difference between the Commercial Insured products and Medicare Advantage is that Medicare members are older, and so have higher health care costs. MA's closest comparable Commercial Insured product is HMO, at $61.45 and MA is $117.63 or 1.9 times HMO. Recall that Medicare Advantage products were typically the fastest growing.

SNP products reflect a similar premium due to health care needs. SNP members face greater expected health needs than the MA population. At $178.99 PMPM, their administrative expenses 1.5 times that of Medicare.

By the same token Medicaid HMO and Medicaid CHIP are relatively low cost products. At $33.67 and $22.95 respectively, they serve populations disproportionally of mothers and babies, and children. Medicaid HMO was 6% higher than Commercial ASO, which like ASO has more modest sales and marketing costs.

Benefit Plan Sponsor Requirements

The administrative costs of health plan products also reflect the buyer of insurance. Commercial ASO products, with administrative expenses of $31.67 PMPM, are purchased by groups that are large enough to self-insure: the same size advantages that permit group assumption of risk also allow sales and marketing and other costs to be spread over more members. Commercial Insured products' administrative costs are 2.1 times that of ASO.

Scope of Benefits

Products with limited scope of benefits can have lower administrative costs. Medicare Supplement offers to Medicare members coverage for health care costs that Fee-for-Service Medicare does not cover. In providing this coverage, Medicare Supplement products execute some but not all tasks of being the primary carrier, Medicare. For instance, Medicare Supplement pays claims but some aspects of claims processing have been already executed by the Medicare program. Medicare Supplement, at $47.11, is 40% of the administrative cost of Medicare Advantage even though the population served is similar.

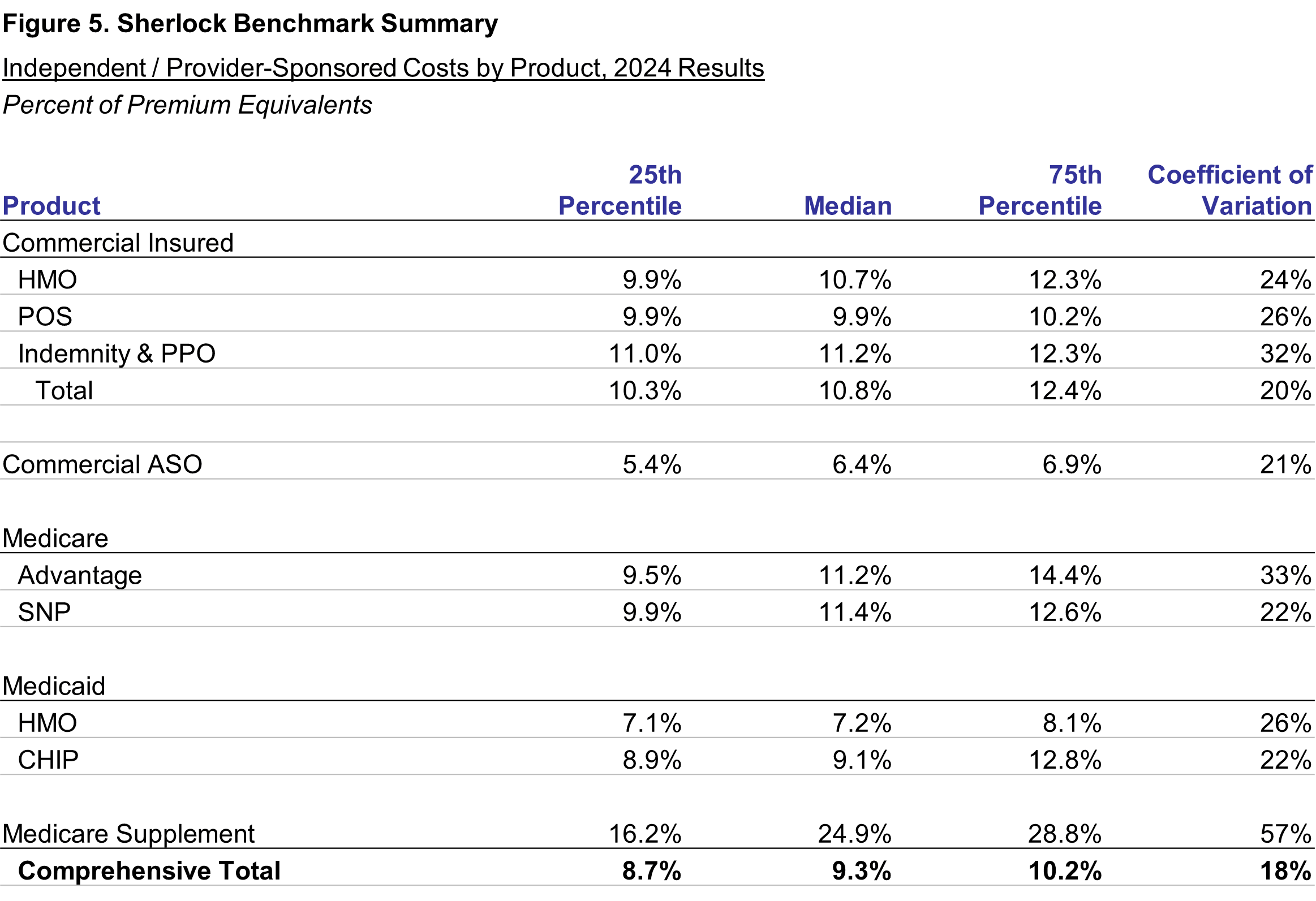

Costs of Independent / Provider-Sponsored Plans, Percent of Premiums by Product

The effects of population requirements, characteristics of the benefit plan sponsor and the scope of benefits change when expenses are considered relative to premiums. The ratios displayed in Figure 5 and in Figure 6 which follows, "premiums" are expressed as premium equivalents in self-insured products. We calculate premium equivalents as the sum of fees paid by self-insured groups plus the health benefits associated with those groups. That is, we add health benefits to ASO fees for that product's denominator. While this is not GAAP, it is more intelligible for the limited purpose of understanding administrative expenses across products.

Population Requirements

Commercial Insured products' cost ranged from 9.9% for POS products to 11.2% for Indemnity and PPO. HMO was 10.7%. Using the percent of premium approach, the difference between Medicare Advantage at 11.2% and Commercial HMO at 10.7% declined to 5% higher rather than over 90% higher using the PMPM approach.

This increased clustering is because of two factors. First, the premium or equivalent denominator is comprised mainly of health benefits, that is, a health benefit ratio of normally 80-90%. Second, many administrative expenses are linked to the health needs of the population served. These include claims, customer services, medical management and the information systems necessary to support them. The remaining differences stem largely from distribution systems' expenses and, for Medicare Supplement, the scope of benefits.

The difference between SNP, at 11.4%, and MA also narrowed from 52% higher PMPM to 2% higher, also illustrating the relationship between health and administrative expenses.

Medicaid HMO was 7.2% of premium equivalents, a 13% premium to ASO, higher than the 6% difference on a PMPM basis. CHIP was 9.1% of premiums.

Benefit Plan Sponsor Requirements

The relationships between ASO and commercial insured on a percent basis were more similar on a percent of premium to PMPM. At 6.4%, administrative costs were 47% of Commercial Insured. For percent of premium, they were 59%.

Scope of Benefits

Medicare Supplement shows that the limited scope of benefits shifts its ranking from low cost on a PMPM basis, to high cost on a percent of premium basis. Its costs were 24.9% of premium equivalents, vastly greater than any other product.

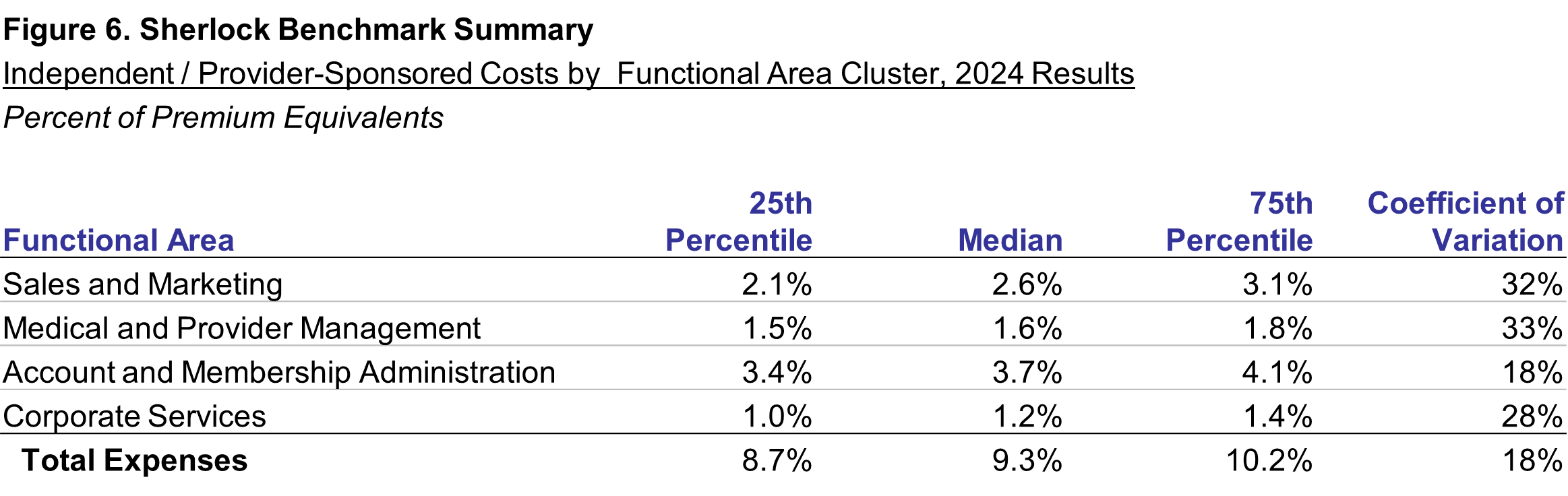

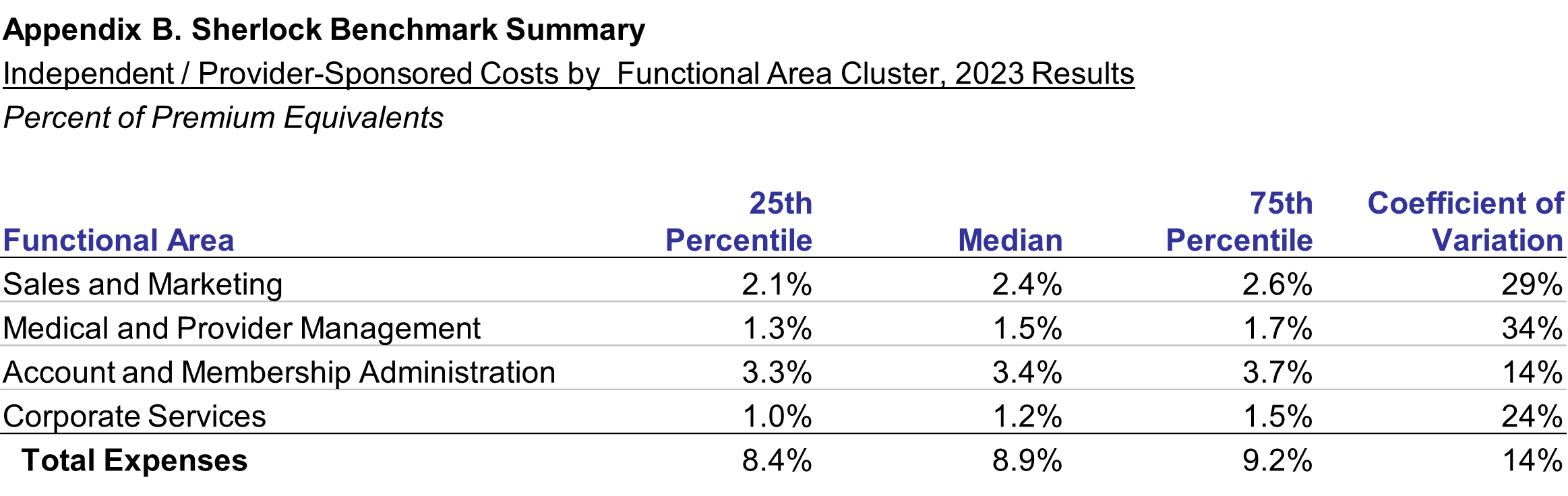

Costs of Independent / Provider-Sponsored Plans, Expense Clusters as Percent of Premium

The administrative expenses were 9.3% of premiums, as shown in Figure 6, 0.4 percentage points greater than for the prior year. Account and Membership Administration was 3.7%, a 0.3% increase from last year. The median Sales and Marketing expenses as a percent of premiums was 2.6%, 0.2 percentage points above last year. Medical and Provider Management was, at 1.6%, 0.1 percent greater than last year. Only Corporate Services, at 1.2% was unchanged from the prior year. There is no discernable relationship to cost growth, unsurprising since both universes and product mixes changed.

Both coefficients of variation and the differences between 25th and 75th percentiles increased, by 4% and 0.8 percentage points, respectively.

Methodology

Characteristics of the Independent / Provider-Sponsored Plans Universe

This analysis is based on the twenty-eighth annual edition of our performance benchmarks for health plans. The Sherlock Benchmarks (Sherlock Expense Evaluation Report or SEER) represents the cumulative experience of more than 1,000 health plan years.

Each peer group in the Sherlock Benchmarks is established to be relatively uniform. So, within that constraint, participation is open to all Independent/Provider Sponsored plans possessing the ability to compile high-quality, segmented financial and operational data. We surveyed the participants to populate the Sherlock Benchmarks and this summary.

This 23rd analysis of IPS plans is based on a peer group of twelve plans who collectively serve approximately 8.7 million members. This universe is quite robust. Participants in this year's study serve 25% of plans in the Health Plan Alliance, and 62% of their members served. Participants serve 1/3 of plans in the Alliance of Community Health Plans, and 64% of their members served. These ratios exclude staff model plans and those focusing on Medicare and Medicaid, the latter two sets are served by other Sherlock Benchmark universes.

Collectively in 2024, the Comprehensive health plan operations of these plans earned annual premiums plus fees of $46 billion, and $60 billion in premium equivalents. The total revenues for the group were $53 billion in 2024 with the additional revenues from MLTSS. The median plan participating in the Sherlock Benchmarks this year served 601,000 people with Comprehensive products. The plans were geographically disbursed, serving 20 states. Ten of this year's twelve participants also participated last year. The average participation experience in the Independent / Provider- Sponsored universe of the Sherlock Benchmarks is 14.8 years.

Collectively, within the comprehensive products, 60.6% of membership was commercial. Of the commercial members approximately 43.9% were served through self-insurance arrangements. Of the commercial insured products 54.8% were HMO.

Medicare Advantage, with 906,000 members, was offered by 11 plans. It was 10.4% of the combined comprehensive membership and 25.2% of revenues for comprehensive products. With SNP, Medicare represents 28.1% of total revenues.

Medicare Supplement, with 187,000 members, was offered by 7 plans and was 2.2% of comprehensive members and 1.1% of revenues for IPS comprehensive products. In total, 38.4% of combined Plan revenues arises from products sold to seniors.

Medicaid HMO, offered by 9 Plans, comprised 25.0% of combined comprehensive membership and 26.8% of comprehensive revenues. CHIP served an additional 1.1% of members and 0.7% of Comprehensive revenues.

Reporting Conventions

We employ some conventions to make the metrics most beneficial for the audience of Plan Management Navigator.

- The trends reported in this analysis are median changes and, when we refer to PMPM or percent of premium ratios, these too are medians. This measure of central tendency reduces the effect of outlying values on overall trends and values. Since each median value is calculated independently, the components cannot be summed.

- References to growth rates hold the universe constant in the comparison years unless otherwise noted. Rates of change called "as reported" are of health plans participating during both comparison years. When we refer to "constant mix" we are calculating rates of change for that same constant set of plans after reweighting each plan's product costs to eliminate the effect of product mix differences between their comparison years.

- Percent of premium ratios are calculated on a premium-equivalent basis. That is, in the case of ASO arrangements, we synthesize premium rates by adding to fees the health benefits incurred by the self-insured group. In this way, premium equivalents sum to all of the expenses of health insurance, including profits earned by the health plan, analogous to actual premiums on insured products. While not in accordance with GAAP, this approach has two advantages: comparability of ASO ratios with those of insured products offered by these plans, and an intuitive appeal to general readers.

- Expenses and revenues exclude capital costs and investment income. We specifically exclude interest and similar debt capital costs, profits and capital formation costs (debt or equity) such as transaction costs, and interest payments to providers under "prompt pay" laws.

- Participants in and licensees of the Sherlock Benchmarks will note that the values for Account and Membership Administration and Total Administrative costs reported here will differ from those reported in the Benchmarks. The values reflected in Navigator include administrative expenses associated with pharmacy and behavioral health while the Sherlock Benchmarks do not. Because of variation in contracting by employers for these benefits and that the administration of these health services is sometimes outsourced by Plans who accept these management responsibilities, the Benchmark reports carve them out.

- Expense trends, along with the PMPM and percent of premium ratios, are calculated before the effect of Miscellaneous Business Taxes. These expenses are a special case among administrative expenses since, short of major reorganization, they are impractical to manage. These taxes are primarily related to the Affordable Care Act, and they may vary based on public policy. For Commercial Insured products, the median PMPM value of such taxes is $7.04 for 2024, compared with $7.08 for 2023. The 2024 value was approximately 10% of total administrative costs for this set of products.

Note on the Sherlock Benchmarks

The Sherlock Benchmarks are the health plan industry's metrics informing the management of administrative activities. They are based on validated surveys of 32 health plans serving 58 million Americans and provide costs and their drivers on key administrative activities. The Benchmarks are reported in multiple universes of health plans: Larger Plans, Blue Cross Blue Shield, Independent / Provider-Sponsored, Medicare and Medicaid.

The Sherlock Benchmarks are the "gold standard" of health plan administrative cost benchmarks. Health plans use them to determine whether their administrative costs are competitive, to prioritize for improvement among numerous specific activities and to identify cost drivers such as staffing ratios that, overall and within functions, can help implement those improvements.

These Plan Management Navigator results are excerpted from the Independent/Provider-Sponsored edition of the 2025 Sherlock Benchmarks. We will be reporting on the results of the other universes in the months that follow. Detailed health plan costs and operational drivers is available by licensing the Sherlock Benchmarks.