Larger health plans, like other large organizations, are often thought to be superior performers whose activities and practices should be emulated or purchased.

In this analysis we find that Larger Blue Cross Blue Shield Plans reported slightly higher median costs than the Blue universe as a whole. When the comparison excludes Larger Plans from the universe, the difference grew.

The source of the data used in this analysis is from the 2024 Larger Plans edition of the Sherlock Benchmarks, a subset of the 2025 Blue Cross Blue Shield benchmarking study.

1Figures 1 and 3 contain PMPM values slightly changed from their original publication.

This analysis does not address other potential operating and financial advantages of larger health plans such as possibly greater access to capital for information systems or new products.

Costs of Larger Plans, Expense Clusters as PMPM and Percent of Premium Equivalents

In 2025, Larger Plans had median Comprehensive administrative expenses of $52.25 PMPM, as shown in Figure 1. For continuously participating Blue Cross Blue Shield Plans, median costs were $51.91 PMPM, $0.34 or 0.7% lower.

Larger Plans had a cost advantage in the Sales and Marketing cluster and the Account and Membership Administration cluster, but costs in the Corporate Services cluster and Medical and Provider Management cluster were higher.

Ratios of administrative expenses to premiums2 had similarities with PMPM results. As shown in Figure 2, Larger Plans' Total Comprehensive administrative expenses were 9.2% of premiums, a tenth of a percentage point higher than the Blue universe.

The other cost differences between the clusters were modest. Medical and Provider Management was slightly lower for Larger Plans, 1.4% versus 1.5% for Blue Plans.

2In this Plan Management Navigator, "premiums" are premiums and/or premium equivalents. This assures comparability by eliminating mix differences between insured and self-insured arrangements.

Costs of Larger Plans, PMPM by Product

Larger Plan product cost values PMPM are shown in Figure 3, with the Blue Cross Blue Shield universe values for the same products for purposes of comparison.

The Plans have fourteen products, 11 that are comprehensive (hospital and physician services), and three additional products that do not include physician services.

Of the eleven Comprehensive products, the Larger Plans had lower costs in eight, including all commercial insured products, the commercial ASO product, and the two Medicare products. But Medicaid plans, and Medicare Supplement, were higher for Larger Plans.

The mix differences between the Larger Plans and the entire set of Blues made a modest difference. Against a 0.7% Comprehensive product cost advantage for Blue Plans, a weighted average of the costs of products using Larger Plans mix is higher by 1.1%.3

The two sets had mix differences with product costs that tended to offset to some degree. While the commitment to MA was similar, 20.5% of Larger Plan members versus 20.6% for the average Blue Plan, the more costly Group product was higher for Blues (5.8% vs. 4.1%) while Medicaid, a lower cost product, was higher for Larger Plans (9.0% vs. 7.5%).

Total Commercial Insured costs were $63.72 PMPM for Larger Plans, 1.7% lower than for Blues as a whole at $64.82. All Insured products were lower with HMO down 2.7%, PPO was down 1.1%, and EPO / POS was lower by 2.8%.

The ASO / ASC product costs of Larger Plans administrative were $35.37 PMPM, slightly higher than $35.31 for the Blue Plans universe. Larger Plans are somewhat more competitive for these products which are more price sensitive.

FEP (Federal Employee Program) is an insured product with few marketing costs relative to other products in Blue Plan portfolios. Larger Plans administer this product at $52.25 PMPM, 9.6% less than in other Blue Plans. The FEP is an important part of Larger Plans' portfolios, averaging 9.5% of Comprehensive membership versus 4.0% for the Blue universe.

Median costs for Larger Plan Individual and Group Medicare products were $138.29 PMPM and $120.30 PMPM, respectively. Notwithstanding the higher product values, Larger Plans costs for these products were lower, 2.6% and 2.4%, respectively.

Also Medicaid costs for Larger Plans were $31.98 PMPM, about 13.7% lower compared to all Blues at $33.06. Medicare Supplement costs for Larger Plans were $69.07 PMPM, about 16% higher than Blue Plans at $59.67 PMPM.

While not included among Blue Comprehensive products, Medicare Special Needs Plans (SNP) was $278.79 PMPM for both sets of Plans. Medicaid Managed Long Term Services and Supports (MLTSS) was $94.80 for both.

The costs of specialty products of Stand-Alone Medicare Part D was 8.5% lower for Larger and Blue Plans, at $17.56. Stand-Alone Dental was $9.53, 5.9% lower.

Costs of Larger Plans, Percent of Premium Equivalents by Product

The percent of premium ratios comparisons for each product is shown in Figure 4. Comprehensive Total costs of 9.2% of premiums for Larger Plans compares to 9.1% for the Blue Cross Blue Shield universe.

Using this metric of costs, Larger Plans ratios were more somewhat likely to be higher. Five of 11 products were higher, with four lower and two identical.

Cluster Comparisons when Sets are Mutually Exclusive

Since the Larger Plan universe is a subset of the Blue Cross Blue Shield universe, the above analyses could mute the cost differences. Removing the Larger Plans from the Blue universe results in mutually exclusive sets.

The results were similar to those derived from Figures 1 and 2, that is, costs for Larger Plans were higher overall by both PMPM and percent of premium ratios.

Figure 5 shows that Total Median Expenses were $0.69 PMPM, or 1.3%, higher for Larger Plans. (This compares to the $0.34 or 0.7% higher when Larger Plans were not excluded from the Blue universe.)

Figure 6 shows medians on a percent of premium equivalents for Larger Plans and Other Blue Plans. Results were similar to those shown in Figure 2, with Larger Plans higher by 0.1 percentage point, or 9.2% versus 9.1%.

Medical and Provider Management was also lower for Larger Plans, 1.3% of premiums versus 1.4%. Conversely, Sales and Marketing was also higher for Larger Plans, 2.1% of premiums versus 2.0%.

Product Comparisons when Sets are Mutually Exclusive

Comparing Blue and Larger Plans by product yields similar results when the Plans are mutually exclusive as to when they are not. Figure 7 shows that Larger Plans Comprehensive Total costs are slightly higher at $52.25 versus $51.56 for Other Blue Plans.

Figure 8 shows this same comparison when expenses are expressed as a percent of premiums. Comprehensive expenses are 9.2% for Larger Plans and 9.1% for Other Blue Plans.

Effect of Mix on PMPM Comparisons

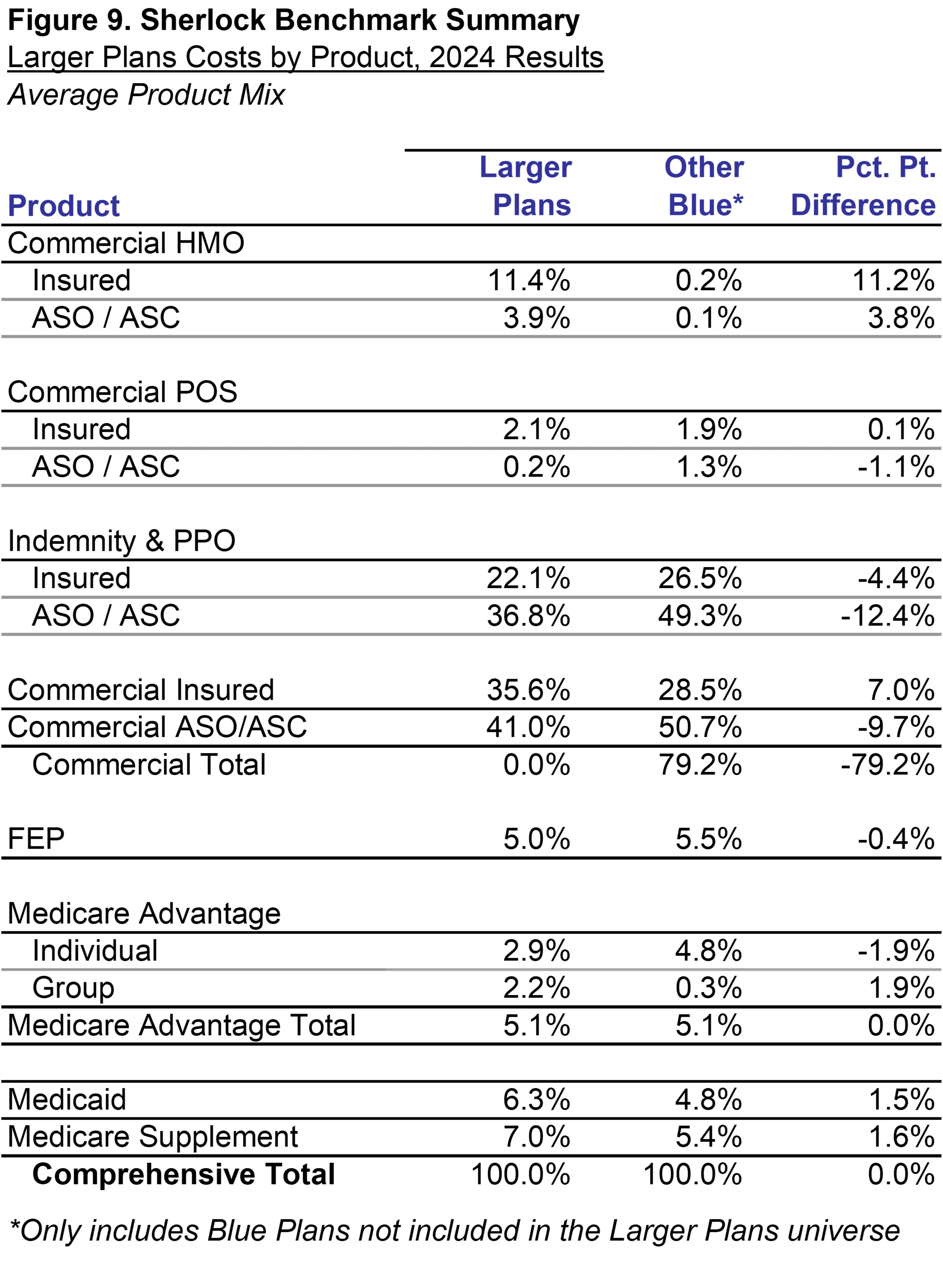

Figure 9 shows average product mix for Larger Plans and Other Blue Plans. They are relatively similar in many respects. Notable differences are the higher FEP for Larger Plans, 9.5% versus 3.1%, and the higher Medicaid for Larger Plans (9.0% vs. 6.7%).

The effect of holding mix constant is to reverse the differences in favor of the Larger Plans. Please see Figure 7 at the bottom of the figure. Costs Reweighted at the Other Blue Plans Average Mix resulted in lower costs for Larger Plans, $51.30 compared to $51.56 for Other Blue Plans.

3The weighted total values differ from the total Comprehensive values because of our use of medians and because the weights are based on membership and the median plan's membership differs from the total membership of all Larger Plans.

Effect of Mix on Percent of Premium Comparisons

Figure 8 shows product expenses on a percent of premium equivalents for Larger Plans compared to Other Blue Plans. While Comprehensive Total was 9.2% for Larger Plans, it was 9.1% for Other Blue Plans.

Costs reweighted at the Other Blue Plans Average Mix resulted in lower costs for Larger Plans, 8.6% compared to 9.2% for Larger Plans.

Two Conclusions

First, both Percents of Premiums and PMPM costs illustrate the importance of considering product mix in the evaluation of performance. When we hold mix constant, the costs of administration flip in favor of Larger Plans.

Second, the modest cost differences between the sets are consistent with our view that, while economies of scale exist in health insurance administration, their effects are narrower and shallower than most assume.

Characteristics of Larger Plans and Other Blue Universes

Collectively, Larger Plans serves 32.3 million people under Comprehensive Products. Total Commercial comprises 26.1 million, Medicaid serves 2.9 million people, and Medicare serves 3.3 million, including Medicare Advantage, Medicare Supplement, and Medicare SNP.

Larger Plans' median mix for premiums or fees for Total Commercial is 67.0%, while Commercial Insured and ASO is 61.4% and 5.6%, respectively. Medicare total was 28.5%, including Medicare Advantage and SNP of 20.5%, Medicare Supplement at 5.5%, and Medicare Group at 4.1%.

The median Larger Plan served about 3.6 million members and the median Blue Cross Blue Shield Plan served 2.0 million members.